CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

Check out our ultimate Philadelphia springtime guide, where we break down events going on all season long and outdoor dining spots perfect for a sunny day.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

Philadelphia's homicide rate is falling but state leaders are still looking at ways to address gun violence. Gov. Josh Shapiro was in West Kensington Friday pushing funding in his budget proposal.

The painter, sculptor and printmaker created work that was hailed as landmarks of the minimalist and post-painterly abstraction art movements.

There's plenty to do in Philadelphia this weekend: a Star Wars-themed haunted house, monster trucks, a Harry Potter-themed drag brunch, concerts and musicals.

A vacant motel in Absecon is coming back to life with the help of some volunteers. The organization has spent the past year transforming the space for veterans experiencing homelessness or in need of housing.

One man is dead and three other people were hospitalized after a shooting in Philadelphia's Kingsessing neighborhood Saturday evening.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

Philadelphia Mayor Cherelle Parker said the city is kicking $3 million toward signing and retention bonuses for teachers - and also announced a new portal for parents to sign up for pre-K.

Trea Turner expects to miss six weeks of the Phillies' season after he injured his left hamstring, according to multiple reports.

A vacant South Jersey motel is coming back to life with the help of some devoted volunteers. They are hoping to make a place for some local heroes to call home. Ray Strickland reports the transformation that's already begun.

A disturbance will ride along a stationary front over the area Saturday. This will generate scattered showers. A cold front approaches from the west tonight triggering scattered showers and periods of steady rain Sunday. Andrew Kozak reports.

A New Jersey church is planning to resume service two weeks after part of its building was destroyed by an intentionally set fire. Meanwhile, residents are picking up their bibs for the Broad Street Run.

Get a look at an aerial view of the Churchill Downs racetrack in Louisville, Kentucky ahead of the Kentucky Derby 2024. Plus, Philadelphia police have two people in custody for the shooting of a teenager at 50th and Spruce streets. Meanwhile a protest encampment on University of Pennsylvania's campus is in its 10th day, and the university has released a statement saying divestment from Israel is illegal under state law. Gov. Josh Shapiro has called on Penn to keep students safe.

Brauhaus Schmitz is presenting its 11th annual Maifest spring celebration on South Street! The authentic German festival on South Street features plenty of beer, food and of course a Maypole set up right in the middle of South Street. Ross DiMattei chats with Brauhaus owner Doug Hager as he sets up for the big block party.

A disturbance will ride along a stationary front over the area Saturday. This will generate scattered showers. A cold front approaches from the west tonight triggering scattered showers and periods of steady rain Sunday. Andrew Kozak reports.

NEXT Weather is about preparation and accuracy. It means No Surprises. So once it's on our radar - it's on yours.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

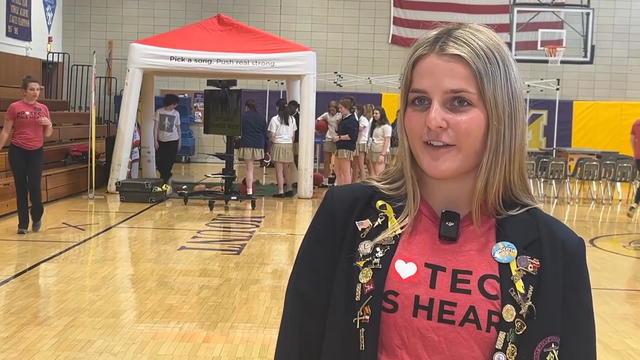

A local teen is leading the charge of over a hundred young people having their hearts checked in Flourtown to honor her sister's memory.

After experiencing female athlete triad herself, medical student Hanna Blankemeier is working to raise awareness.

Cassie Donahue and her mom Jane are lacing up their sneakers for Sunday's Broad Street Run and it's all for a good cause. The duo is helping raise money for cancer research in honor of their late father and husband.

Recall involves shelled walnuts distributed in 19 states and sold in bulk bins at natural food and co-op stores.

California is partnering with a New Jersey-based pharmaceutical company to purchase a generic version of Narcan, the most well-known version of naloxone that can save a person's life during an opioid overdose.

Before heading outside to enjoy Philadelphia's warm weather, know the differences between heat stroke and heat exhaustion and what to do if you or someone you know is experiencing symptoms.

Dutch medical device maker Philips says it's reached a $1.1 billion deal in the United States to settle lawsuits over faulty sleep machines in a case that's rocked the company.

Around 1 in 5 retail milk samples had tested positive for the bird flu virus, but further tests show it was not infectious.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

Trea Turner expects to miss six weeks of the Phillies' season after he injured his left hamstring, according to multiple reports.

Bohm extended his hitting streak to 16 games with an RBI single, Marsh drove in two runs and the surging Philadelphia Phillies defeated the San Francisco Giants 4-3.

The report Spencer Turnbull will remain in the Philadelphia Phillies rotation is on hold, for now.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

ASAP is holding a free-week long program that will teach girls in Philadelphia schools how to play chess.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

Glen Macnow has decided to retire after 31 years at 94 WIP. Before signing off, Macnow joins CBS News Philadelphia sports anchor/reporter Pat Gallen on the latest episode of "Gallen of Questions."

Caitlin Clark was busy breaking records all season at Iowa, returning to the national championship game. Now, she'll take her talents to the WNBA after being drafted first overall by the Indiana Fever. Former Villanova star Maddy Siegrist joins Pat Gallen on this week's Gallen of Question to discuss her transition from college to the WNBA and what Clark can expect.

CBS Philadelphia Sports Anchor/Report Pat Gallen sits down with the Phanatic's best friend, Tom Burgoyne, before America's favorite mascot's 46th birthday.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

Philadelphia's homicide rate is falling but state leaders are still looking at ways to address gun violence. Gov. Josh Shapiro was in West Kensington Friday pushing funding in his budget proposal.

The painter, sculptor and printmaker created work that was hailed as landmarks of the minimalist and post-painterly abstraction art movements.

There's plenty to do in Philadelphia this weekend: a Star Wars-themed haunted house, monster trucks, a Harry Potter-themed drag brunch, concerts and musicals.

A vacant motel in Absecon is coming back to life with the help of some volunteers. The organization has spent the past year transforming the space for veterans experiencing homelessness or in need of housing.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

Philadelphia's homicide rate is falling but state leaders are still looking at ways to address gun violence. Gov. Josh Shapiro was in West Kensington Friday pushing funding in his budget proposal.

One man is dead and three other people were hospitalized after a shooting in Philadelphia's Kingsessing neighborhood Saturday evening.

Philadelphia Mayor Cherelle Parker said the city is kicking $3 million toward signing and retention bonuses for teachers - and also announced a new portal for parents to sign up for pre-K.

It looks like steady rain will hold off a few hours after the Broad Street Run starts on Sunday, May 5 in Philadelphia.

A vacant motel in Absecon is coming back to life with the help of some volunteers. The organization has spent the past year transforming the space for veterans experiencing homelessness or in need of housing.

Washington Township police in Gloucester County said a loose pig named Pumba was brought home safely after he escaped his enclosure on Friday.

It looks like steady rain will hold off a few hours after the Broad Street Run starts on Sunday, May 5 in Philadelphia.

Colonial Manor United Methodist Church in West Deptford, New Jersey is rising from the ashes following an arson, and it's all thanks to help from the community.

Meet one of the 10 "all-star" teachers the Philadelphia Phillies will honor Friday during their Teacher Appreciation Night at Citizens Bank Park.

It looks like steady rain will hold off a few hours after the Broad Street Run starts on Sunday, May 5 in Philadelphia.

Tune in on Thursday, June 20, from 6 a.m. to 8 p.m. as we help raise money for childhood cancer research.

Philadelphia's weather is definitely cooling down from earlier in the week, and the region will see rain on the weekend.

A program is working to preserve the past as several military monuments sit near Brandywine Park in Wilmington that haven't been touched or cleaned in decades.

emperatures have climbed back into the 80s for Thursday's weather in Philadelphia. The weekend is colder and cloudy with rain during Sunday's Broad Street Run.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

A local teen is leading the charge of over a hundred young people having their hearts checked in Flourtown to honor her sister's memory.

After experiencing female athlete triad herself, medical student Hanna Blankemeier is working to raise awareness.

Cassie Donahue and her mom Jane are lacing up their sneakers for Sunday's Broad Street Run and it's all for a good cause. The duo is helping raise money for cancer research in honor of their late father and husband.

Recall involves shelled walnuts distributed in 19 states and sold in bulk bins at natural food and co-op stores.

California is partnering with a New Jersey-based pharmaceutical company to purchase a generic version of Narcan, the most well-known version of naloxone that can save a person's life during an opioid overdose.

Regulators have closed Republic First Bank's 32 branches in Pennsylvania, New Jersey and New York and they will be taken over by Fulton Bank.

For the second time in a month, Aramark union workers will go on strike, this time during Game 3 of the Philadelphia 76ers-New York Knicks playoff series at the Wells Fargo Center.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Wawa is officially in central Pennsylvania.

A tractor-trailer truck got stuck under an Amtrak bridge on Route 420 in Prospect Park, Pennsylvania on Friday morning.

A driver and passenger on Route 202 were killed after their vehicle crossed into oncoming traffic and struck a car-carrier truck in North Wales, Pennsylvania on Monday, according to police.

Starting Monday, the city of Philadelphia is cracking down on drivers who park on streets in the 14 neighborhoods being cleaned as part of the Mechanical Street Cleaning program.

The fatal crash in Boothwyn shut down Route 322 from Chelsea Parkway to Creek Parkway for several hours on Wednesday afternoon.

"Intercity bus carriers" will be relocating from the Spring Garden Street area of the city as soon as Labor Day, Philadelphia transportation officials told a Northern Liberties neighborhood group.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

It was just the 10th Kentucky Derby decided by a nose, and the first since Grindstone wore the garland of red roses in 1996.

Trea Turner expects to miss six weeks of the Phillies' season after he injured his left hamstring, according to multiple reports.

Bohm extended his hitting streak to 16 games with an RBI single, Marsh drove in two runs and the surging Philadelphia Phillies defeated the San Francisco Giants 4-3.

The report Spencer Turnbull will remain in the Philadelphia Phillies rotation is on hold, for now.

The 2024 Met Gala theme is "The Garden of Time" — to go along with the spring exhibition, titled "Sleeping Beauties: Reawakening Fashion."

There's plenty to do in Philadelphia this weekend: a Star Wars-themed haunted house, monster trucks, a Harry Potter-themed drag brunch, concerts and musicals.

By HughE Dillon.

See who's nominated for the 77th annual Tony Awards. The Tonys will air live on CBS and Paramount+ on Sunday, June 16.

Paramount said long-time CEO Bob Bakish will leave the company, which is in discussions to explore a sale or merger.

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

ASAP is holding a free-week long program that will teach girls in Philadelphia schools how to play chess.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

A vacant South Jersey motel is coming back to life with the help of some devoted volunteers. They are hoping to make a place for some local heroes to call home. Ray Strickland reports the transformation that's already begun.

A disturbance will ride along a stationary front over the area Saturday. This will generate scattered showers. A cold front approaches from the west tonight triggering scattered showers and periods of steady rain Sunday. Andrew Kozak reports.

A New Jersey church is planning to resume service two weeks after part of its building was destroyed by an intentionally set fire. Meanwhile, residents are picking up their bibs for the Broad Street Run.

Get a look at an aerial view of the Churchill Downs racetrack in Louisville, Kentucky ahead of the Kentucky Derby 2024. Plus, Philadelphia police have two people in custody for the shooting of a teenager at 50th and Spruce streets. Meanwhile a protest encampment on University of Pennsylvania's campus is in its 10th day, and the university has released a statement saying divestment from Israel is illegal under state law. Gov. Josh Shapiro has called on Penn to keep students safe.

Brauhaus Schmitz is presenting its 11th annual Maifest spring celebration on South Street! The authentic German festival on South Street features plenty of beer, food and of course a Maypole set up right in the middle of South Street. Ross DiMattei chats with Brauhaus owner Doug Hager as he sets up for the big block party.