CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

Check out our ultimate Philadelphia springtime guide, where we break down events going on all season long and outdoor dining spots perfect for a sunny day.

Police in riot gear early Friday morning cleared the pro-Palestinian encampment set up on Penn's campus in Philadelphia.

Dave Shaw's fandom began with a Chase Utley home run in 2012. Twelve years later, Shaw is helping grow baseball in the United Kingdom with "UK Phillies."

A student named Thomas was introduced as Tamome. Molly became Milena. Sarah Virginia became Syer Ovoon Jean June.

As a widespread display of the Northern Lights will hover in the Philadelphia area over the next two days, we could see it if the weather cooperates.

A Pennsylvania state trooper involved in a traffic stop on I-76 in Philadelphia that gained attention on social media is no longer employed by PSP, the agency said.

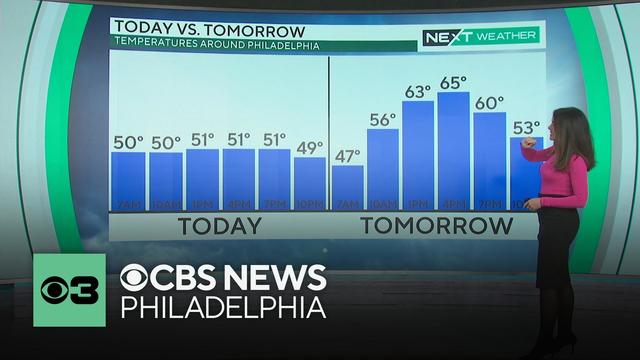

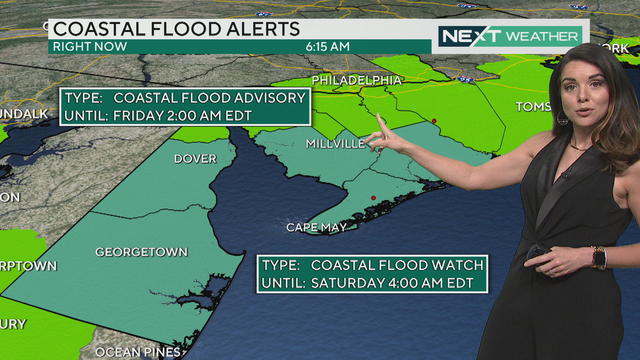

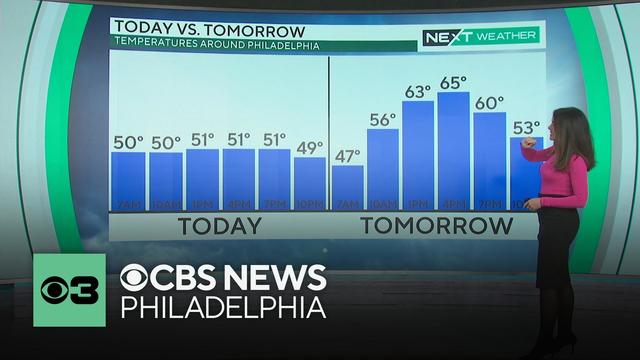

Temperatures will remain in the 50s with rain around all day Friday, but sunshine returns Saturday before more rain for Mother's Day

At Global Leadership Academy Southwest, students set out on learning excursions because the charter school leadership believes the best learning happens outside the classroom.

A senior from North Allegheny Senior High School and a senior from State College Area High School were among the 161 winners.

The Philadelphia 76ers are entering the most important offseason of the Joel Embiid era, and Daryl Morey is armed with cap space to get a third star to make a run for an NBA title.

Dave Shaw of "UK Phillies" joins Pat Gallen in this week's episode of "Gallen of Questions" to talk everything Phillies, meeting Chase Utley, which Premier League team best compares to the Phils, and more.

Philadelphia and Penn police cleared the pro-Palestinian protest encampment on campus and cited 33 people with civic citations for trespassing.

Temple University is investigating a possible case of antisemitism involving a Jewish fraternity, and Philadelphia and Penn police moved early Friday morning to disband a pro-Palestinian encampment set up on College Green — more on these stories in your Digital Brief for Friday, May 10, 2024.

The 85th annual Dad Vail Regatta gets underway Friday, and for the second straight year, it's in New Jersey. CBS Philadelphia reporter Wakisha Bailey has how La Salle University's women's rowing team prepared for this year's event.

It's an ugly Friday in the Philadelphia region - it's drizzly, dreary, and downright chilly for the time of the year. Meteorologist Kate Bilo has your Friday weather forecast for Philly.

Temperatures will remain in the 50s with rain around all day Friday, but sunshine returns Saturday before more rain for Mother's Day

NEXT Weather is about preparation and accuracy. It means No Surprises. So once it's on our radar - it's on yours.

A Delaware County woman finally has what doctors call a miracle baby. This coming Mother's Day is extra special with a journey that spanned nine years.

Artz Philadelphia is designed for people living with dementia and their care partners.

ACL injuries are common and often involve difficult surgery and a long recovery, but a new collagen implant is changing that.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

Recall includes yogurt pretzels and other confections sold by retailers such as Dollar General, HyVee, Target and Walmart.

A first-of-its-kind genetic treatment at Children's Hospital of Philadelphia is restoring and improving vision.

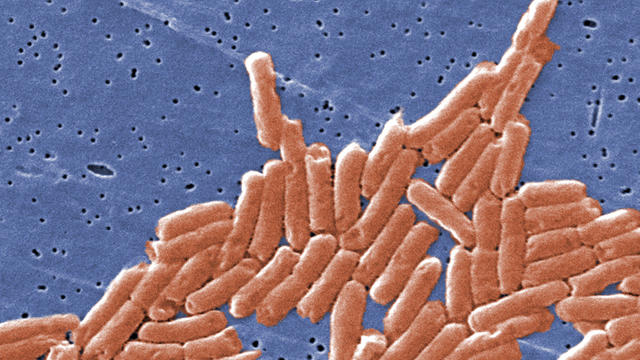

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

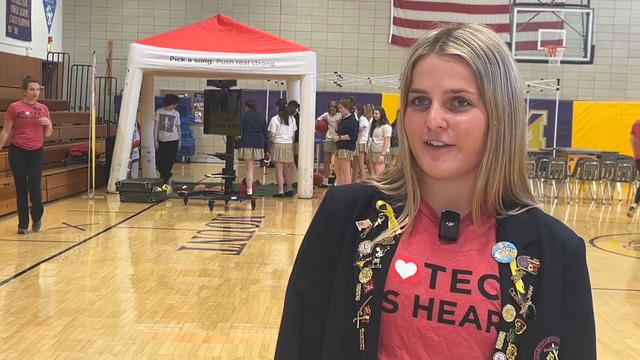

A local teen is leading the charge of over a hundred young people having their hearts checked in Flourtown to honor her sister's memory.

After experiencing female athlete triad herself, medical student Hanna Blankemeier is working to raise awareness.

Dave Shaw's fandom began with a Chase Utley home run in 2012. Twelve years later, Shaw is helping grow baseball in the United Kingdom with "UK Phillies."

The Philadelphia 76ers are entering the most important offseason of the Joel Embiid era, and Daryl Morey is armed with cap space to get a third star to make a run for an NBA title.

The 85th Jefferson Dad Vail Regatta is happening in South Jersey this weekend, and for the first time, a woman is at the helm.

Cavan Sullivan, 14, is the youngest player in Philadelphia Union history to be added to the first-team roster. He's also the fifth-youngest signing in Major League Soccer history.

Chris Bassitt tossed three-hit ball and struck out six over 6 2/3 innings and Vladimir Guerrero Jr. had three hits and an RBI to lead the Toronto Blue Jays to a 5-3 victory that ended the Philadelphia Phillies' home winning streak at 11 games.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

At Global Leadership Academy Southwest, students set out on learning excursions because the charter school leadership believes the best learning happens outside the classroom.

ASAP is holding a free-week long program that will teach girls in Philadelphia schools how to play chess.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

Dave Shaw's fandom began with a Chase Utley home run in 2012. Twelve years later, Shaw is helping grow baseball in the United Kingdom with "UK Phillies."

Dave Shaw of "UK Phillies" joins Pat Gallen in this week's episode of "Gallen of Questions" to talk everything Phillies, meeting Chase Utley, which Premier League team best compares to the Phils, and more.

Glen Macnow has decided to retire after 31 years at 94 WIP. Before signing off, Macnow joins CBS News Philadelphia sports anchor/reporter Pat Gallen on the latest episode of "Gallen of Questions."

Police in riot gear early Friday morning cleared the pro-Palestinian encampment set up on Penn's campus in Philadelphia.

Dave Shaw's fandom began with a Chase Utley home run in 2012. Twelve years later, Shaw is helping grow baseball in the United Kingdom with "UK Phillies."

A student named Thomas was introduced as Tamome. Molly became Milena. Sarah Virginia became Syer Ovoon Jean June.

As a widespread display of the Northern Lights will hover in the Philadelphia area over the next two days, we could see it if the weather cooperates.

A Pennsylvania state trooper involved in a traffic stop on I-76 in Philadelphia that gained attention on social media is no longer employed by PSP, the agency said.

Dave Shaw's fandom began with a Chase Utley home run in 2012. Twelve years later, Shaw is helping grow baseball in the United Kingdom with "UK Phillies."

A Pennsylvania state trooper involved in a traffic stop on I-76 in Philadelphia that gained attention on social media is no longer employed by PSP, the agency said.

Temperatures will remain in the 50s with rain around all day Friday, but sunshine returns Saturday before more rain for Mother's Day

At Global Leadership Academy Southwest, students set out on learning excursions because the charter school leadership believes the best learning happens outside the classroom.

Police in riot gear early Friday morning cleared the pro-Palestinian encampment set up on Penn's campus in Philadelphia.

Temperatures will remain in the 50s with rain around all day Friday, but sunshine returns Saturday before more rain for Mother's Day

It's graduation week at Rowan University and despite a major health setback, one medical school student not only graduated Thursday but she's also dedicating her life to helping others.

The 85th Jefferson Dad Vail Regatta is happening in South Jersey this weekend, and for the first time, a woman is at the helm.

A house fire in Waterford Township, New Jersey left one person dead and seven first responders injured, officials said.

Evesham police kicked off the Police Unity Tour Thursday to remember officers who did not make it home at the end of their shifts, including Deptford officer Bobby Shisler.

Temperatures will remain in the 50s with rain around all day Friday, but sunshine returns Saturday before more rain for Mother's Day

Thursday starts off cloudy and in the 60s before rain rolls in tonight, cooling us down for a damp, chilly Friday.

Wednesday morning is kicking off with scattered showers that could produce lightning, high winds and downpours for some in the Philadelphia region.

Tuesday starts with fog and clouds before a sunny day - with a chance of thunderstorms early Wednesday morning.

A 10-year-old boy is dead after he was struck by a teen driver whose car ran off the road in Wilmington, Delaware.

A Delaware County woman finally has what doctors call a miracle baby. This coming Mother's Day is extra special with a journey that spanned nine years.

Artz Philadelphia is designed for people living with dementia and their care partners.

ACL injuries are common and often involve difficult surgery and a long recovery, but a new collagen implant is changing that.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

Recall includes yogurt pretzels and other confections sold by retailers such as Dollar General, HyVee, Target and Walmart.

An iconic local jeweler is under new management as the owners turned over the business Monday to several longtime employees for free.

California is partnering with a New Jersey-based pharmaceutical company to purchase a generic version of Narcan, the most well-known version of naloxone that can save a person's life during an opioid overdose.

Regulators have closed Republic First Bank's 32 branches in Pennsylvania, New Jersey and New York and they will be taken over by Fulton Bank.

For the second time in a month, Aramark union workers will go on strike, this time during Game 3 of the Philadelphia 76ers-New York Knicks playoff series at the Wells Fargo Center.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

The Phillies are encouraging fans heading to Wednesday's game to use public transportation and plan accordingly for traffic.

Part of the New Jersey Turnpike Southbound was blocked Tuesday due to a crash involving a tractor-trailer.

The 45th Annual Broad Street Run happens Sunday, May 5. Here's how to get there and where to park.

A tractor-trailer truck got stuck under an Amtrak bridge on Route 420 in Prospect Park, Pennsylvania on Friday morning.

A driver and passenger on Route 202 were killed after their vehicle crossed into oncoming traffic and struck a car-carrier truck in North Wales, Pennsylvania on Monday, according to police.

Dave Shaw's fandom began with a Chase Utley home run in 2012. Twelve years later, Shaw is helping grow baseball in the United Kingdom with "UK Phillies."

The Philadelphia 76ers are entering the most important offseason of the Joel Embiid era, and Daryl Morey is armed with cap space to get a third star to make a run for an NBA title.

The 85th Jefferson Dad Vail Regatta is happening in South Jersey this weekend, and for the first time, a woman is at the helm.

Cavan Sullivan, 14, is the youngest player in Philadelphia Union history to be added to the first-team roster. He's also the fifth-youngest signing in Major League Soccer history.

Chris Bassitt tossed three-hit ball and struck out six over 6 2/3 innings and Vladimir Guerrero Jr. had three hits and an RBI to lead the Toronto Blue Jays to a 5-3 victory that ended the Philadelphia Phillies' home winning streak at 11 games.

Taylor Swift's The Eras Tour began its European leg with four dates at the La Defense Arena in Paris with a revamped setlist.

This will be the first baby for Hailey and Justin Beiber, who announced their pregnancy after more than five years of marriage.

"Grotesquerie" star Niecy Nash took to social media to show off her new co-worker, Travis Kelce, on the new horror-drama TV series by "American Horror Story" creator Ryan Murphy.

Brian Fox, a fellow producer and engineer at Albini's Electrical Audio studio in Chicago, confirmed Albini passed away Tuesday night from a heart attack.

The stars came out for the the 2024 Met Gala in New York City. See some of the most eye-catching outfits of the night.

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

At Global Leadership Academy Southwest, students set out on learning excursions because the charter school leadership believes the best learning happens outside the classroom.

ASAP is holding a free-week long program that will teach girls in Philadelphia schools how to play chess.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Dave Shaw of "UK Phillies" joins Pat Gallen in this week's episode of "Gallen of Questions" to talk everything Phillies, meeting Chase Utley, which Premier League team best compares to the Phils, and more.

Philadelphia and Penn police cleared the pro-Palestinian protest encampment on campus and cited 33 people with civic citations for trespassing.

Temple University is investigating a possible case of antisemitism involving a Jewish fraternity, and Philadelphia and Penn police moved early Friday morning to disband a pro-Palestinian encampment set up on College Green — more on these stories in your Digital Brief for Friday, May 10, 2024.

The 85th annual Dad Vail Regatta gets underway Friday, and for the second straight year, it's in New Jersey. CBS Philadelphia reporter Wakisha Bailey has how La Salle University's women's rowing team prepared for this year's event.

It's an ugly Friday in the Philadelphia region - it's drizzly, dreary, and downright chilly for the time of the year. Meteorologist Kate Bilo has your Friday weather forecast for Philly.