CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

A 76-year-old man was charged with shooting and killing his wife and adult daughter, the Chester County District Attorney's Office and Pennsylvania State Police announced on Friday.

Students at Pennridge High School celebrated their efforts in raising big money for the Special Olympics of Pennsylvania.

The Philadelphia Eagles enter the 2024 NFL draft with eight picks, with three in the first two rounds. Keep track of the Birds' draft picks here.

Philadelphia 76ers center Joel Embiid says he's been diagnosed with Bell's palsy, a medical condition that causes facial muscle weakness, pain and discomfort.

A student was hospitalized and two other students were arrested after two fights broke out at Abington High School in Montgomery County leading to a lockdown Friday afternoon, police said in a news release.

With a relatively low average monthly cost of living and a low crime rate, this little-known town has a lot to offer retirees according to one report.

A Pottstown, Pennsylvania priest charged over $40,000 to a parish credit card related to gaming apps including virtual slot machines and Pokemon Go.

Jessica Kartalija, who anchors the evening newscasts at CBS News Philadelphia, was honored by the Pennsylvania Association of Broadcasters.

Two 15-year-old boys, a 16-year-old girl and a 16-year-old boy will be charged with aggravated assault, conspiracy, simple assault and recklessly endangering another person, Assistant District Attorney William Fritze said.

Earth Month is a chance to re-evaluate the role we play in protecting our planet. Now, one homegrown organization has developed unique programs to help you understand our rapidly changing climate. Tammie Souza reports.

A gallery owner and an artist with Kensington ties hope that art as an expression can be a force of positive change in their community.

Stephanie Stahl talks to Dr. Leah Croll of Temple Health who explains what is Bell's palsy after Sixers center Joel Embiid revealed he was diagnosed after Thursday night's Game 3 victory against the New York Knicks.

"In this encampment, the mood has been incredible," Sophia Rosser said on Friday. "I already feel like, even though it hasn't been a full day yet, just the community that we're building, it's just really beautiful to see." Emma Herndon said the goal of the encampment is for the university to disclose its investments, divest from Israeli companies and defend the voices of Palestinian students.

Students at Pennridge High School celebrate their efforts raising big money for the Special Olympics of Pennsylvania. Kim Hudson reports.

There will be plenty of sunshine in the Philadelphia region Friday afternoon before a weekend warmup. Meteorologist Kate Bilo has your weather forecast for April 26, 2024.

NEXT Weather is about preparation and accuracy. It means No Surprises. So once it's on our radar - it's on yours.

Philadelphia 76ers center Joel Embiid says he's been diagnosed with Bell's palsy, a medical condition that causes facial muscle weakness, pain and discomfort.

Saturday is National Drug Take Back Day and we've got everything you need to know about why and the risks of holding onto expired medications.

Joel Embiid has been experiencing Bell's palsy symptoms, he said after Philadelphia's 125-114 win over the New York Knicks.

The Sandy Rollman Ovarian Cancer Foundation will celebrate the 20th anniversary of the Sandy Sprint Philadelphia 5k run/walk on Saturday.

A New Jersey woman has received a first-of-its-kind transplant using a modified pig kidney along with a heart pump.

Federal officials say they're double checking whether pasteurization has eradicated the danger from possible bird virus particles in milk.

Tick bites can cause a range of illnesses — and as the weather warms up, ticks can be particularly prevalent. Delaware County leaders are working to keep residents aware of the dangers ticks bring.

Pennsylvania has the second highest number of infant botulism cases in the country, many concentrated in Montgomery County.

More cases of measles have been reported so far this year, in less than four months, than in all of 2022. As of April 18, 125 cases were reported in 17 states, including Pennsylvania, New Jersey and Delaware.

Students at Pennridge High School celebrated their efforts in raising big money for the Special Olympics of Pennsylvania.

Lincoln Financial Field will host Round 15 of the AMA Supercross Championship, the first time supercross is returning to Philadelphia in 40 years.

Philadelphia 76ers center Joel Embiid says he's been diagnosed with Bell's palsy, a medical condition that causes facial muscle weakness, pain and discomfort.

Joel Embiid has been experiencing Bell's palsy symptoms, he said after Philadelphia's 125-114 win over the New York Knicks.

The Philadelphia Eagles enter the 2024 NFL draft with eight picks, with three in the first two rounds. Keep track of the Birds' draft picks here.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Caitlin Clark was busy breaking records all season at Iowa, returning to the national championship game. Now, she'll take her talents to the WNBA after being drafted first overall by the Indiana Fever. Former Villanova star Maddy Siegrist joins Pat Gallen on this week's Gallen of Question to discuss her transition from college to the WNBA and what Clark can expect.

CBS Philadelphia Sports Anchor/Report Pat Gallen sits down with the Phanatic's best friend, Tom Burgoyne, before America's favorite mascot's 46th birthday.

Casey Pitocchelli chats with Pat Gallen about how he founded Rare Vntg and discusses the Phillies' Nike City Connect jerseys and Philly sports on the latest episode of Gallen of Questions.

A 76-year-old man was charged with shooting and killing his wife and adult daughter, the Chester County District Attorney's Office and Pennsylvania State Police announced on Friday.

Students at Pennridge High School celebrated their efforts in raising big money for the Special Olympics of Pennsylvania.

The Philadelphia Eagles enter the 2024 NFL draft with eight picks, with three in the first two rounds. Keep track of the Birds' draft picks here.

Philadelphia 76ers center Joel Embiid says he's been diagnosed with Bell's palsy, a medical condition that causes facial muscle weakness, pain and discomfort.

A student was hospitalized and two other students were arrested after two fights broke out at Abington High School in Montgomery County leading to a lockdown Friday afternoon, police said in a news release.

A 76-year-old man was charged with shooting and killing his wife and adult daughter, the Chester County District Attorney's Office and Pennsylvania State Police announced on Friday.

Students at Pennridge High School celebrated their efforts in raising big money for the Special Olympics of Pennsylvania.

A student was hospitalized and two other students were arrested after two fights broke out at Abington High School in Montgomery County leading to a lockdown Friday afternoon, police said in a news release.

A Pottstown, Pennsylvania priest charged over $40,000 to a parish credit card related to gaming apps including virtual slot machines and Pokemon Go.

Jessica Kartalija, who anchors the evening newscasts at CBS News Philadelphia, was honored by the Pennsylvania Association of Broadcasters.

After a chilly start, bright and clear skies will make for a crisp Friday with a high of 65 before a cloudy weekend with a chance of showers on Saturday and potential Sunday night thunderstorms.

Opposition is growing in one Atlantic City neighborhood over possibly expanding the area where recreational marijuana businesses can open.

At least two Princeton University students were arrested Thursday at a pro-Palestinian protest on campus where students began setting up tents.

The Penn Relays will bring thousands of athletes in Philadelphia this weekend. If you're heading to Franklin Field, here's what you need to know.

Thursday is cool and cloudy with a few peeks of sunshine later in the day. Temps drop close to freezing Friday morning, but the second half of the weekend kicks off a summerlike warmup.

After a chilly start, bright and clear skies will make for a crisp Friday with a high of 65 before a cloudy weekend with a chance of showers on Saturday and potential Sunday night thunderstorms.

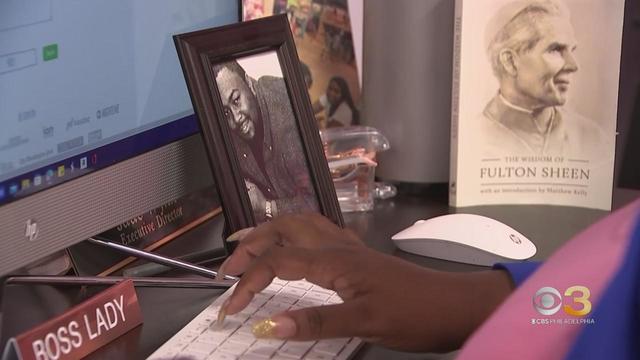

Camay Mitchell De Silva was killed at Delaware State University. Her family wants to make sure she's remembered for the life she lived.

The Penn Relays will bring thousands of athletes in Philadelphia this weekend. If you're heading to Franklin Field, here's what you need to know.

Thursday is cool and cloudy with a few peeks of sunshine later in the day. Temps drop close to freezing Friday morning, but the second half of the weekend kicks off a summerlike warmup.

Camay De Silva's loved ones gathered at a Wilmington park to remember her and release balloons in her honor.

Philadelphia 76ers center Joel Embiid says he's been diagnosed with Bell's palsy, a medical condition that causes facial muscle weakness, pain and discomfort.

Saturday is National Drug Take Back Day and we've got everything you need to know about why and the risks of holding onto expired medications.

Joel Embiid has been experiencing Bell's palsy symptoms, he said after Philadelphia's 125-114 win over the New York Knicks.

The Sandy Rollman Ovarian Cancer Foundation will celebrate the 20th anniversary of the Sandy Sprint Philadelphia 5k run/walk on Saturday.

A New Jersey woman has received a first-of-its-kind transplant using a modified pig kidney along with a heart pump.

For the second time in a month, Aramark union workers will go on strike, this time during Game 3 of the Philadelphia 76ers-New York Knicks playoff series at the Wells Fargo Center.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Wawa is officially in central Pennsylvania.

Cove Pocono Resorts' two other properties, Cove Haven Resort and Paradise Stream Resort, will remain open despite the closure of the Pocono Palace.

Nine life-sized sculptures made by world-renowned artist Seward Johnson are on loan to Philadelphia's Frankford Avenue in Mayfair until mid-September.

The fatal crash in Boothwyn shut down Route 322 from Chelsea Parkway to Creek Parkway for several hours on Wednesday afternoon.

"Intercity bus carriers" will be relocating from the Spring Garden Street area of the city as soon as Labor Day, Philadelphia transportation officials told a Northern Liberties neighborhood group.

Three construction workers died on I-83 in York County, Pennsylvania after a truck struck their vehicle in an active work zone, Pennsylvania State Police said.

One person died in a car accident in Pennsauken, Camden County, Tuesday afternoon, Pennsauken police said.

All lanes of the Pennsylvania Turnpike near Quakertown have reopened after a dump truck overturned Monday morning, according to the Pennsylvania Turnpike Commission.

Students at Pennridge High School celebrated their efforts in raising big money for the Special Olympics of Pennsylvania.

Lincoln Financial Field will host Round 15 of the AMA Supercross Championship, the first time supercross is returning to Philadelphia in 40 years.

Philadelphia 76ers center Joel Embiid says he's been diagnosed with Bell's palsy, a medical condition that causes facial muscle weakness, pain and discomfort.

Joel Embiid has been experiencing Bell's palsy symptoms, he said after Philadelphia's 125-114 win over the New York Knicks.

The Philadelphia Eagles enter the 2024 NFL draft with eight picks, with three in the first two rounds. Keep track of the Birds' draft picks here.

Harvey Weinstein's 2020 conviction on felony sex crime charges has been overturned by the State of New York Court of Appeals.

Play on Philly provides students with ambitious, high-quality music education at almost no cost.

The Iron Menace coaster at Dorney Park takes you 15 stories into the sky before a 95-degree drop tops out at speeds of 64 mph. We got a sneak peek and rode the brand new ride.

Construction is halfway complete on the Lansdowne Theater, the focus of an $18 million restoration project. Once the building reopens, it will serve as a concert hall.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Earth Month is a chance to re-evaluate the role we play in protecting our planet. Now, one homegrown organization has developed unique programs to help you understand our rapidly changing climate. Tammie Souza reports.

A gallery owner and an artist with Kensington ties hope that art as an expression can be a force of positive change in their community.

Stephanie Stahl talks to Dr. Leah Croll of Temple Health who explains what is Bell's palsy after Sixers center Joel Embiid revealed he was diagnosed after Thursday night's Game 3 victory against the New York Knicks.

"In this encampment, the mood has been incredible," Sophia Rosser said on Friday. "I already feel like, even though it hasn't been a full day yet, just the community that we're building, it's just really beautiful to see." Emma Herndon said the goal of the encampment is for the university to disclose its investments, divest from Israeli companies and defend the voices of Palestinian students.

Students at Pennridge High School celebrate their efforts raising big money for the Special Olympics of Pennsylvania. Kim Hudson reports.