CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

Check out our ultimate Philadelphia springtime guide, where we break down events going on all season long and outdoor dining spots perfect for a sunny day.

Part of the New Jersey Turnpike Southbound is blocked today due to a crash involving a tractor-trailer.

Kensington Avenue will be shut down from East Orleans Street to Allegheny Avenue on Wednesday as city workers clear an encampment of people in the neighborhood's main corridor.

A 10-year-old boy is dead after he was struck by a teen driver whose car ran off the road in Wilmington, Delaware.

One of South Philadelphia's iconic cheesesteak shops is preparing for a grand reopening this week.

Police in Dover, Delaware, said two men were arrested for the murder of 18-year-old Camay Mitchell De Silva on Delaware State University's campus in April.

University of Pennsylvania Interim President J. Larry Jameson is calling for de-escalation and reiterated the pro-Palestinian protest encampment set up on College Green violates university policy.

Officials in Bucks County say a new video enforcement program has captured thousands of drivers running red lights at two of their busiest intersections.

A New Jersey state trooper died Sunday while training at the NJSP headquarters in Ewing, Mercer County, Gov. Phil Murphy said.

After getting bounced by the New York Knicks in round one, it's now onto the future for Daryl Morey and the Philadelphia 76ers.

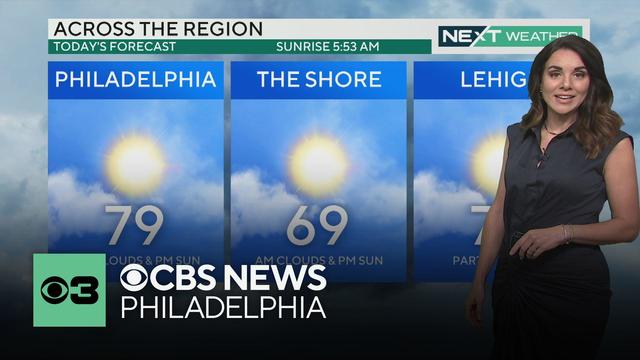

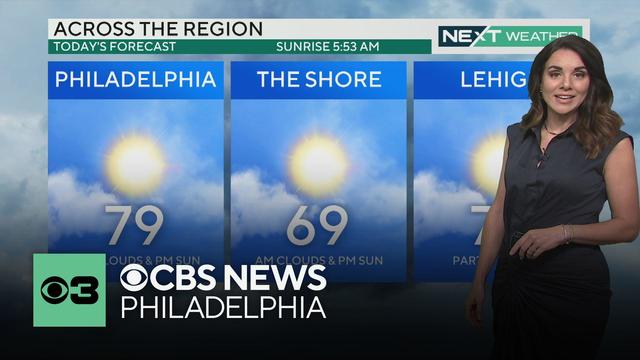

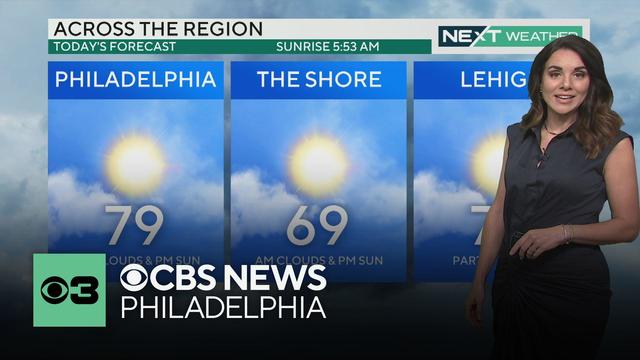

Early fog and cloud cover should lift around the Philadelphia region on Tuesday morning, and we'll see sunshine bringing the high temperature near 80 in the city and the Lehigh Valley, Kate Bilo reports.

The New Jersey Turnpike southbound is partially blocked in Mount Laurel after a crash involving a tractor-trailer. Chandler Lutz has the latest on the scene and how you can get around it.

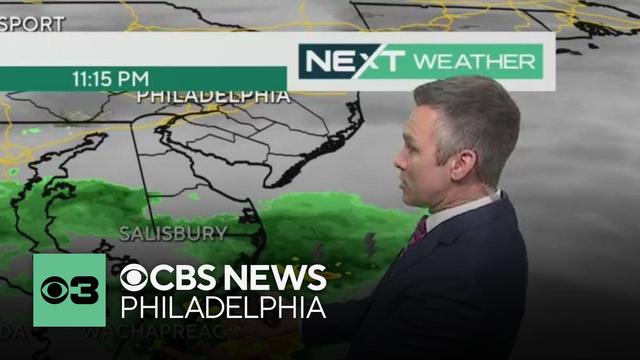

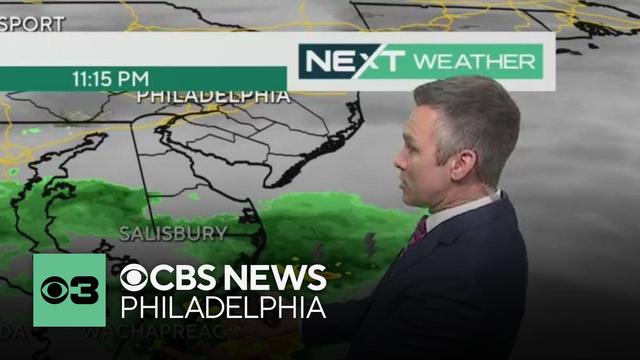

Bill Kelly says showers will return on Tuesday morning in the Philadelphia region before the sun comes out. It will be a high of 80 degrees.

The former Philadelphia Eagle took part in the golf tournament in Gladwyne on Monday.

Third-generation owner Frank Olivieri showed CBS News Philadelphia around the new Pat's King of Steaks in South Philly on Monday night ahead of Wednesday's grand reopening.

Early fog and cloud cover should lift around the Philadelphia region on Tuesday morning, and we'll see sunshine bringing the high temperature near 80 in the city and the Lehigh Valley, Kate Bilo reports.

NEXT Weather is about preparation and accuracy. It means No Surprises. So once it's on our radar - it's on yours.

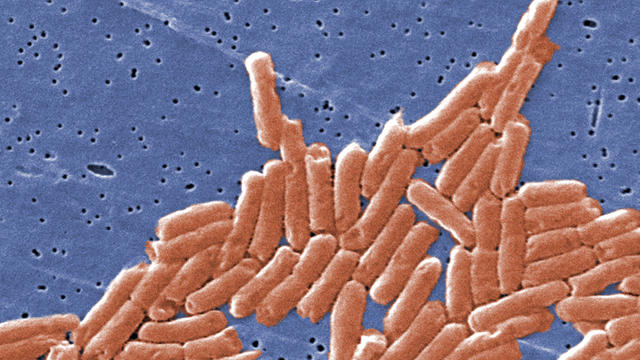

Recall includes yogurt pretzels and other confections sold by retailers such as Dollar General, HyVee, Target and Walmart.

A first-of-its-kind genetic treatment at Children's Hospital of Philadelphia is restoring and improving vision.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

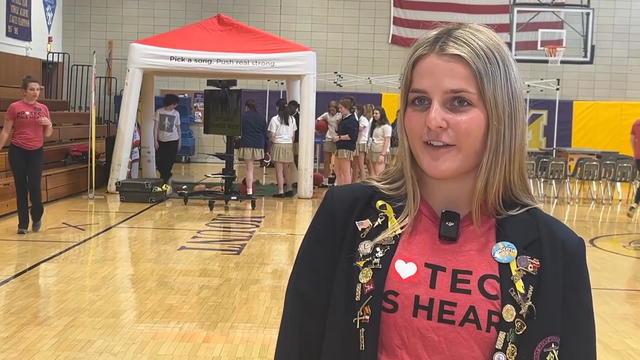

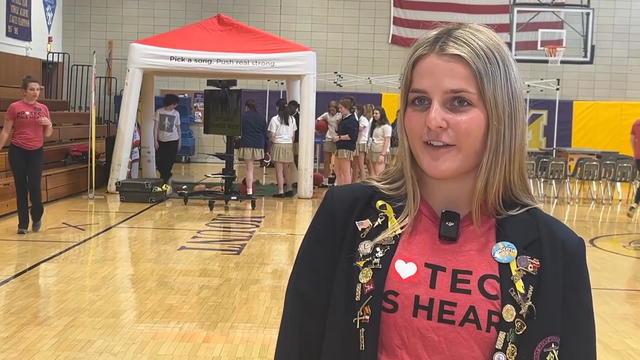

A local teen is leading the charge of over a hundred young people having their hearts checked in Flourtown to honor her sister's memory.

After experiencing female athlete triad herself, medical student Hanna Blankemeier is working to raise awareness.

Cassie Donahue and her mom Jane are lacing up their sneakers for Sunday's Broad Street Run and it's all for a good cause. The duo is helping raise money for cancer research in honor of their late father and husband.

Recall involves shelled walnuts distributed in 19 states and sold in bulk bins at natural food and co-op stores.

California is partnering with a New Jersey-based pharmaceutical company to purchase a generic version of Narcan, the most well-known version of naloxone that can save a person's life during an opioid overdose.

Before heading outside to enjoy Philadelphia's warm weather, know the differences between heat stroke and heat exhaustion and what to do if you or someone you know is experiencing symptoms.

After getting bounced by the New York Knicks in round one, it's now onto the future for Daryl Morey and the Philadelphia 76ers.

Bryce Harper hit a three-run homer and Zack Wheeler struck out 11 in seven innings to help the Philadelphia Phillies complete a four-game sweep of the San Francisco Giants with a 6-1 win.

Tom Brady took his share of barbs from comedians, former teammates and his longtime coach during a made-for-streaming comedy live event on Netflix -- but one joke seemed to anger him.

Bryce Harper launched a three-run homer, Alec Bohm extended his hitting streak to 18 games and the Philadelphia Phillies defeated the San Francisco Giants 5-4 for their fifth straight victory.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

ASAP is holding a free-week long program that will teach girls in Philadelphia schools how to play chess.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

Glen Macnow has decided to retire after 31 years at 94 WIP. Before signing off, Macnow joins CBS News Philadelphia sports anchor/reporter Pat Gallen on the latest episode of "Gallen of Questions."

Caitlin Clark was busy breaking records all season at Iowa, returning to the national championship game. Now, she'll take her talents to the WNBA after being drafted first overall by the Indiana Fever. Former Villanova star Maddy Siegrist joins Pat Gallen on this week's Gallen of Question to discuss her transition from college to the WNBA and what Clark can expect.

CBS Philadelphia Sports Anchor/Report Pat Gallen sits down with the Phanatic's best friend, Tom Burgoyne, before America's favorite mascot's 46th birthday.

Part of the New Jersey Turnpike Southbound is blocked today due to a crash involving a tractor-trailer.

Kensington Avenue will be shut down from East Orleans Street to Allegheny Avenue on Wednesday as city workers clear an encampment of people in the neighborhood's main corridor.

A 10-year-old boy is dead after he was struck by a teen driver whose car ran off the road in Wilmington, Delaware.

One of South Philadelphia's iconic cheesesteak shops is preparing for a grand reopening this week.

Police in Dover, Delaware, said two men were arrested for the murder of 18-year-old Camay Mitchell De Silva on Delaware State University's campus in April.

One of South Philadelphia's iconic cheesesteak shops is preparing for a grand reopening this week.

The high-tech lab allows students to help police solve crimes in Delaware County, Pennsylvania.

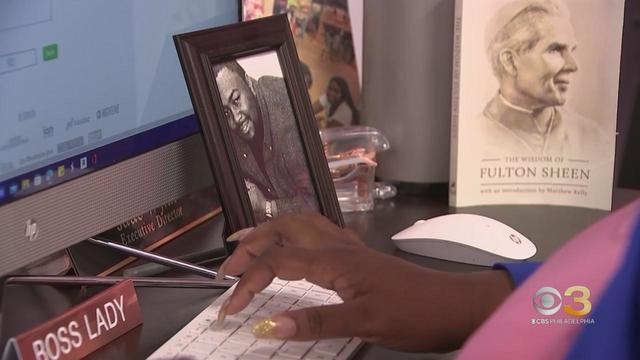

An iconic local jeweler is under new management as the owners turned over the business Monday to several longtime employees for free.

A first-of-its-kind genetic treatment at Children's Hospital of Philadelphia is restoring and improving vision.

Kensington Avenue will be shut down from East Orleans Street to Allegheny Avenue on Wednesday as city workers clear an encampment of people in the neighborhood's main corridor.

Part of the New Jersey Turnpike Southbound is blocked today due to a crash involving a tractor-trailer.

An iconic local jeweler is under new management as the owners turned over the business Monday to several longtime employees for free.

Mike Kleidermacher, who survived the Holocaust as a child, served as the keynote speaker at the Sara and Sam Schoffer Holocaust Resource Center at Stockton University.

Philadelphia will see (but not very far) a foggy start to the week Monday. Kate Bilo tracks when the fog clears out and when Philly gets more rain.

A New Jersey state trooper died Sunday while training at the NJSP headquarters in Ewing, Mercer County, Gov. Phil Murphy said.

A 10-year-old boy is dead after he was struck by a teen driver whose car ran off the road in Wilmington, Delaware.

Police in Dover, Delaware, said two men were arrested for the murder of 18-year-old Camay Mitchell De Silva on Delaware State University's campus in April.

Philadelphia will see (but not very far) a foggy start to the week Monday. Kate Bilo tracks when the fog clears out and when Philly gets more rain.

A whale washed up along the beach in Delaware near the Indian River Inlet on Sunday, the Marine Education, Research and Rehabilitation Institute said.

Rainy conditions are sweeping into the Philadelphia region Sunday as the Broad Street Run is underway.

Recall includes yogurt pretzels and other confections sold by retailers such as Dollar General, HyVee, Target and Walmart.

A first-of-its-kind genetic treatment at Children's Hospital of Philadelphia is restoring and improving vision.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

A local teen is leading the charge of over a hundred young people having their hearts checked in Flourtown to honor her sister's memory.

After experiencing female athlete triad herself, medical student Hanna Blankemeier is working to raise awareness.

An iconic local jeweler is under new management as the owners turned over the business Monday to several longtime employees for free.

California is partnering with a New Jersey-based pharmaceutical company to purchase a generic version of Narcan, the most well-known version of naloxone that can save a person's life during an opioid overdose.

Regulators have closed Republic First Bank's 32 branches in Pennsylvania, New Jersey and New York and they will be taken over by Fulton Bank.

For the second time in a month, Aramark union workers will go on strike, this time during Game 3 of the Philadelphia 76ers-New York Knicks playoff series at the Wells Fargo Center.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Part of the New Jersey Turnpike Southbound is blocked today due to a crash involving a tractor-trailer.

The 45th Annual Broad Street Run happens Sunday, May 5. Here's how to get there and where to park.

A tractor-trailer truck got stuck under an Amtrak bridge on Route 420 in Prospect Park, Pennsylvania on Friday morning.

A driver and passenger on Route 202 were killed after their vehicle crossed into oncoming traffic and struck a car-carrier truck in North Wales, Pennsylvania on Monday, according to police.

Starting Monday, the city of Philadelphia is cracking down on drivers who park on streets in the 14 neighborhoods being cleaned as part of the Mechanical Street Cleaning program.

After getting bounced by the New York Knicks in round one, it's now onto the future for Daryl Morey and the Philadelphia 76ers.

Bryce Harper hit a three-run homer and Zack Wheeler struck out 11 in seven innings to help the Philadelphia Phillies complete a four-game sweep of the San Francisco Giants with a 6-1 win.

Tom Brady took his share of barbs from comedians, former teammates and his longtime coach during a made-for-streaming comedy live event on Netflix -- but one joke seemed to anger him.

Bryce Harper launched a three-run homer, Alec Bohm extended his hitting streak to 18 games and the Philadelphia Phillies defeated the San Francisco Giants 5-4 for their fifth straight victory.

Ranger Suárez pitched six strong innings, Whit Merrifield homered and the streaking Philadelphia Phillies routed the San Francisco Giants 14-3 on Saturday night.

The stars came out for the the 2024 Met Gala in New York City. See some of the most eye-catching outfits of the night.

Kendrick Lamar and Drake have each released several ruthless diss tracks against each other, with Kendrick alleging Drake has a secret daughter and making other disturbing accusations.

'Bob Hearts Abishola', the acclaimed comedy, is signing off after its fifth season on CBS.

Tom Brady took his share of barbs from comedians, former teammates and his longtime coach during a made-for-streaming comedy live event on Netflix -- but one joke seemed to anger him.

Bernard Hill died Sunday at 79. The actor was known for his roles in "Lord of the Rings" and "Titanic."

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

ASAP is holding a free-week long program that will teach girls in Philadelphia schools how to play chess.

Great Valley High School senior Lucca Ruggieri is already working his dream job: campaign manager for Republican Neil Young's run at Pennsylvania's 6th Congressional District.

While students aren't using real tattoo machines, an elective class at West Philadelphia High School is teaching students the techniques to create intricate tattoo designs.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Early fog and cloud cover should lift around the Philadelphia region on Tuesday morning, and we'll see sunshine bringing the high temperature near 80 in the city and the Lehigh Valley, Kate Bilo reports.

The New Jersey Turnpike southbound is partially blocked in Mount Laurel after a crash involving a tractor-trailer. Chandler Lutz has the latest on the scene and how you can get around it.

Bill Kelly says showers will return on Tuesday morning in the Philadelphia region before the sun comes out. It will be a high of 80 degrees.

The former Philadelphia Eagle took part in the golf tournament in Gladwyne on Monday.

Third-generation owner Frank Olivieri showed CBS News Philadelphia around the new Pat's King of Steaks in South Philly on Monday night ahead of Wednesday's grand reopening.