CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

The warrant is for a violation of a protection from abuse order, police said. Sources said Kevin Boyle texted his estranged wife, which is a violation of that order.

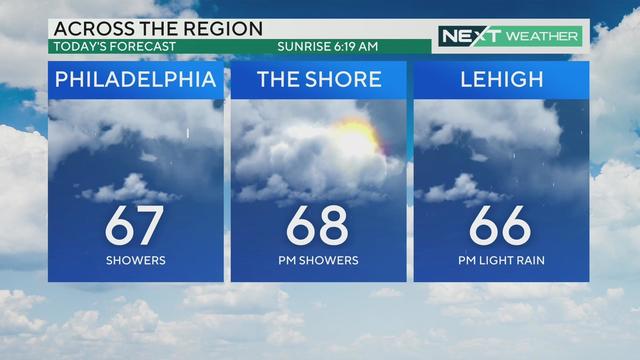

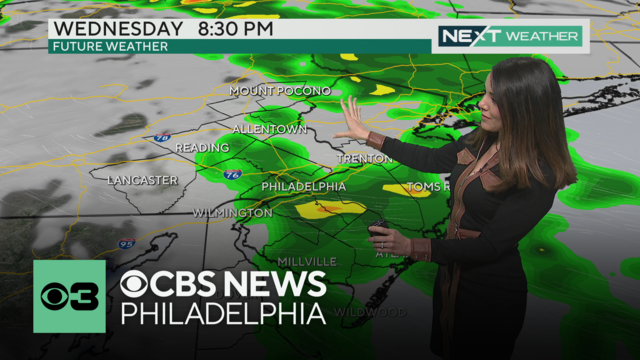

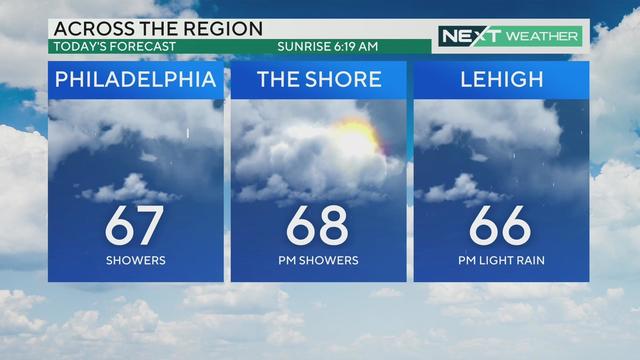

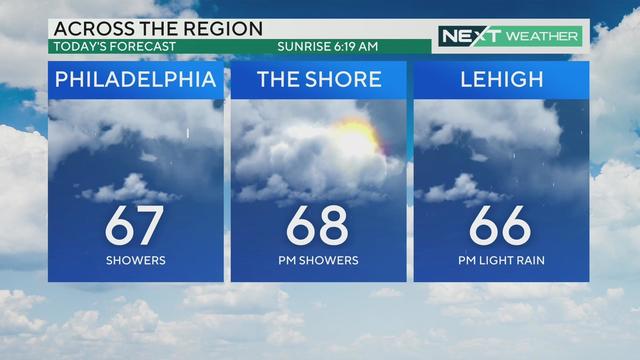

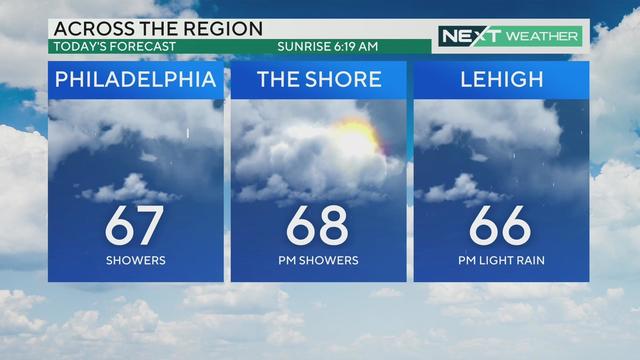

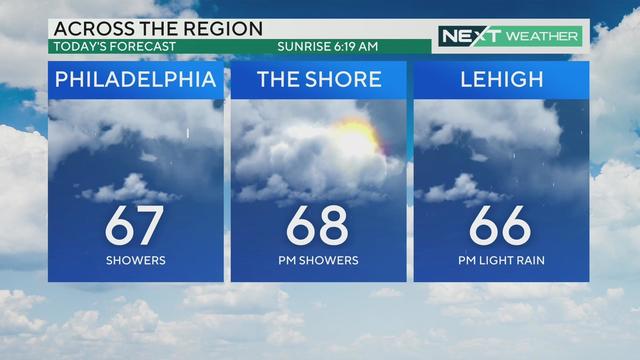

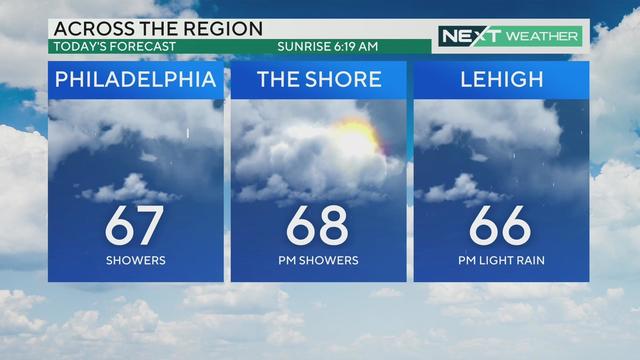

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

Ranger Suarez needed 23 pitches to get through the ninth but earned the second complete game shutout of his career in a 5-0 victory over the Rockies. He allowed seven hits and struck out eight batters.

Joel Embiid and the Philadelphia 76ers will face Jimmy Butler and the Miami Heat in the NBA Play-In Tournament on Wednesday night at the Wells Fargo Center.

Kevin Hart will have a homecoming stop on Dec. 4 at The Met Philadelphia on his 2024 "Acting My Age" tour.

Atlantic City Mayor Marty Small Sr. will not resign after he and his wife were charged with abusing their daughter, according to his lawyer.

Dynamic duo Future & Metro Boomin as "One Big Family" will be "Slimed In" at the Wells Fargo Center this August for the "We Trust You Tour."

The move to increase police presence and enforcement on North Broad Street began Monday, officials said.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

Philadelphia Police say six children are in custody after the group stole two cars in the city's Parkwood neighborhood, and ended up overturning one of the vehicles early Wednesday morning. One of the kids was taken to the hospital to be treated for a cut on their hand.

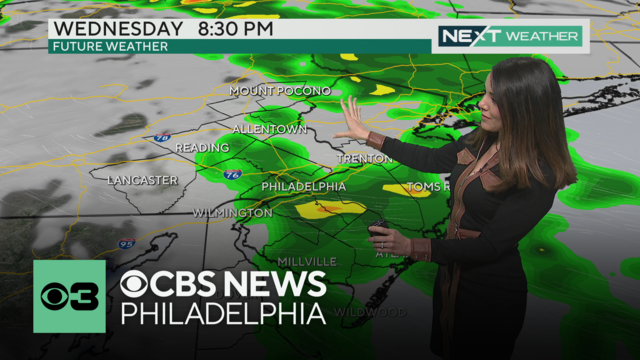

Don't be fooled by early breaks of sunshine. A warm front will keep temperatures relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds are in place by 11 a.m. By noon, light, scattered showers arrive in the Delaware Valley and steadier bands of rain continue into the afternoon and evening. Kate Bilo has your forecast.

Showers return by Wednesday afternoon and continue through Wednesday night with a few rumbles. Bill Kelly has the forecast.

Leveling was a process used by the school district that reassigned teachers to different schools every fall in Philadelphia depending on the school's enrollment.

Family, friends and classmates gathered to pray and remember Thaduba Turay, who was killed by a wrong-way driver on I-95 in South Philadelphia.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

NEXT Weather is about preparation and accuracy. It means No Surprises. So once it's on our radar - it's on yours.

David O'Brian will run in the Donor Dash in Philadelphia later this month to celebrate his daughter, an organ donor who died 10 years ago.

Montgomery County's Office of Public Health is investigating an increase in whooping cough cases primarily among high school students, a county spokesperson told CBS News Philadelphia on Monday.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

The latest CDC data from 2021 shows more than 1,200 women died of pregnancy complications up from 754 deaths in 2019.

Federal authorities are warning that unregulated Botox products are linked to an outbreak of botulism-like illnesses.

A unique initiative helps unlock the potential of people with autism by providing job training.

Professional singer and actress Julia Rae is on a mission to give back at Children's Hospital of Philadelphia by sharing gifts called "Feel Better Boxes."

The prepackaged boxes of deli meat, cheese and crackers are not a healthy choice for kids, advocacy group says.

New Jersey is failing to protect thousands employed at Atlantic City gambling establishments, lawsuit claims.

Joel Embiid and the Philadelphia 76ers will face Jimmy Butler and the Miami Heat in the NBA Play-In Tournament on Wednesday night at the Wells Fargo Center.

Ranger Suarez needed 23 pitches to get through the ninth but earned the second complete game shutout of his career in a 5-0 victory over the Rockies. He allowed seven hits and struck out eight batters.

The Flyers needed a lot of help to make the playoffs but ultimately fell short in the regular season finale and lost 2-1 to the Washington Capitals.

Joel Embiid is again dealing with injuries headed into the NBA playoffs.

IceWorks Skating Club is making history as its Theatre on Ice team will compete in France and represent Team USA at the 2024 Nations' Cup.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Casey Pitocchelli chats with Pat Gallen about how he founded Rare Vntg and discusses the Phillies' Nike City Connect jerseys and Philly sports on the latest episode of Gallen of Questions.

"Dancing on My Own" has been the Philadelphia Phillies' celebration soundtrack for the last two years. In this week's episode, Unterberger, a Philly guy and Philly sports fan, comprises a list of potential new victory songs for the 2024 season.

Hannah Hidalgo, a Merchantville, New Jersey, native starred at Paul VI High School before heading to Notre Dame. Hidalgo sat down with Pat Gallen for a special Gallen of Questions web extra.

The warrant is for a violation of a protection from abuse order, police said. Sources said Kevin Boyle texted his estranged wife, which is a violation of that order.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

Ranger Suarez needed 23 pitches to get through the ninth but earned the second complete game shutout of his career in a 5-0 victory over the Rockies. He allowed seven hits and struck out eight batters.

Joel Embiid and the Philadelphia 76ers will face Jimmy Butler and the Miami Heat in the NBA Play-In Tournament on Wednesday night at the Wells Fargo Center.

Kevin Hart will have a homecoming stop on Dec. 4 at The Met Philadelphia on his 2024 "Acting My Age" tour.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

Kevin Hart will have a homecoming stop on Dec. 4 at The Met Philadelphia on his 2024 "Acting My Age" tour.

Dynamic duo Future & Metro Boomin as "One Big Family" will be "Slimed In" at the Wells Fargo Center this August for the "We Trust You Tour."

The move to increase police presence and enforcement on North Broad Street began Monday, officials said.

IceWorks Skating Club is making history as its Theatre on Ice team will compete in France and represent Team USA at the 2024 Nations' Cup.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

A body was recovered from the Delaware River near the Adventure Aquarium in Camden on Tuesday afternoon, police said.

PFAS, also known as "forever chemicals," are everywhere and can linger permanently in air, water and soil. In response, Aqua New Jersey just unveiled a new water treatment system to help remove them from drinking water.

CBS News Philadelphia went on a tour Tuesday to an important spot vital to fighting fires and became the first line of defense before crews made their way to the railroad flames.

One person died in a car accident in Pennsauken, Camden County, Tuesday afternoon, Pennsauken police said.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

High temperatures Tuesday will reach the mid-70s with abundantly sunny skies, a light breeze and slight reduction in the humidity before more rain and chilly air moves in Wednesday.

Monday makes a run for 80 degrees, setting us up for the warmest day of the week and warmest day of the year so far. Later in the day, a thunderstorm could develop in South Jersey and Delaware.

30-year-old Dempsey Walters faces prison time after pleading guilty to assaulting two teenagers over a doorbell prank Friday.

The Philadelphia region's weather is off to a blustery start this weekend, with winds whipping throughout the day Saturday. We'll see some sunshine once clouds clear out.

David O'Brian will run in the Donor Dash in Philadelphia later this month to celebrate his daughter, an organ donor who died 10 years ago.

Montgomery County's Office of Public Health is investigating an increase in whooping cough cases primarily among high school students, a county spokesperson told CBS News Philadelphia on Monday.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

The latest CDC data from 2021 shows more than 1,200 women died of pregnancy complications up from 754 deaths in 2019.

Federal authorities are warning that unregulated Botox products are linked to an outbreak of botulism-like illnesses.

Nine life-sized sculptures made by world-renowned artist Seward Johnson are on loan to Philadelphia's Frankford Avenue in Mayfair until mid-September.

After a taste of summer on Monday, many Jersey Shore business owners and managers are still looking for summer workers.

Atlantic City, New Jersey's nine casinos collectively had lower profits in 2023 compared to 2022 - but three casinos were able to increase profit.

Tuesday, April 16 is Wawa Day, when the company expects to give away about 1.5 million cups of free coffee to celebrate the 60th anniversary of its first convenience store.

It's been nearly a year since the Philadelphia commissioned studies looking into the economic impact of the proposed 76 Place at Market East. Where are the numbers?

One person died in a car accident in Pennsauken, Camden County, Tuesday afternoon, Pennsauken police said.

All lanes of the Pennsylvania Turnpike near Quakertown have reopened after a dump truck overturned Monday morning, according to the Pennsylvania Turnpike Commission.

A 21-year-old woman was killed after her car was struck by a drunken driver on I-95 northbound in Philadelphia, Pennsylvania State Police said Sunday.

Flooding closed multiple roads around the Philadelphia region for the morning commute on Friday, but they began reopening after around 8 a.m.

Ten months after a tanker truck fire collapsed a portion of I-95 in Northeast Philadelphia, PennDOT says the permanent fix is about "three-quarters of the way done."

Joel Embiid and the Philadelphia 76ers will face Jimmy Butler and the Miami Heat in the NBA Play-In Tournament on Wednesday night at the Wells Fargo Center.

Ranger Suarez needed 23 pitches to get through the ninth but earned the second complete game shutout of his career in a 5-0 victory over the Rockies. He allowed seven hits and struck out eight batters.

The Flyers needed a lot of help to make the playoffs but ultimately fell short in the regular season finale and lost 2-1 to the Washington Capitals.

Joel Embiid is again dealing with injuries headed into the NBA playoffs.

IceWorks Skating Club is making history as its Theatre on Ice team will compete in France and represent Team USA at the 2024 Nations' Cup.

Kevin Hart will have a homecoming stop on Dec. 4 at The Met Philadelphia on his 2024 "Acting My Age" tour.

Dynamic duo Future & Metro Boomin as "One Big Family" will be "Slimed In" at the Wells Fargo Center this August for the "We Trust You Tour."

Bad Bunny fans might have to see his Philadelphia concert a day earlier depending on the outcome of the 76ers-Heat game at the Wells Fargo Center.

Jellyroll, a Pennsylvania wedding band, is suing the award-winning country music artist Jelly Roll, alleging they had the name first and the latter is infringing on a trademark.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Mercy Career and Technical High School senior Taylor Houseman was one of two students selected to give a SEPTA bus a brand new look.

On this week's Focusing on the Future and the first day of Women's History Month, CBS Philadelphia talked with one high school senior who is making history.

Philadelphia Police say six children are in custody after the group stole two cars in the city's Parkwood neighborhood, and ended up overturning one of the vehicles early Wednesday morning. One of the kids was taken to the hospital to be treated for a cut on their hand.

Don't be fooled by early breaks of sunshine. A warm front will keep temperatures relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds are in place by 11 a.m. By noon, light, scattered showers arrive in the Delaware Valley and steadier bands of rain continue into the afternoon and evening. Kate Bilo has your forecast.

Showers return by Wednesday afternoon and continue through Wednesday night with a few rumbles. Bill Kelly has the forecast.

Leveling was a process used by the school district that reassigned teachers to different schools every fall in Philadelphia depending on the school's enrollment.

Family, friends and classmates gathered to pray and remember Thaduba Turay, who was killed by a wrong-way driver on I-95 in South Philadelphia.