CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

Philadelphia police are releasing surveillance video that they hope will help identify a suspect in an East Mount Airy shooting.

Dozens of firefighters battled a fire on the Atlantic City boardwalk on Thursday night, officials said.

A proposed waterfront park along the Schuylkill near 30th Street Station would feature a public pool, a natural beach and an entertainment venue.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

The swing set at Anna Verna Playground in FDR Park is the largest in North America. The playground opened in Fall 2023, so this will be its first spring and summer season.

Two U.S. officials tell CBS News an Israeli missile has hit Iran in apparent retaliation for the recent drone and missile attack on the Jewish state.

A middle school student is being charged after allegedly attacking another Pennbrook Middle School student with what schoolmates describe as a Stanley cup.

Taylor Swift's new album "The Tortured Poets Department" is finally here. Here are some events in the Philadelphia area to celebrate the Berks County native's latest record.

Jalen Hurts announced he will donate $200,000 to the School District of Philadelphia to purchase air conditioning units for 10 schools.

Eagles quarterback Jalen Hurts is giving $200,000 to the School District of Philadelphia to buy air conditioning units for 10 schools.

The Rothman Orthopaedics Roller Rink has officially opened at Dilworth Park in Center City for another season.

An area of Route 202 that had seen issues due to sinkholes in the past is now reopened after soft soil caused a dip in the roadway to form. A more permanent fix to the sinkhole issues will be completed over the summer.

Students at Pennbrook Middle School in North Wales, Pennsylvania are shaken up after a seventh grader was attacked in the cafeteria- with what one student said was a Stanley cup. Kim Hudson has the latest from the Montgomery County school.

Philadelphia Parks and Recreation is kicking off the spring and summer with a celebration at Anna Verna Playground in FDR Park - home to the largest swingset in North America. Jan Carabeo takes you to the award-winning play space and even heads down a slide.

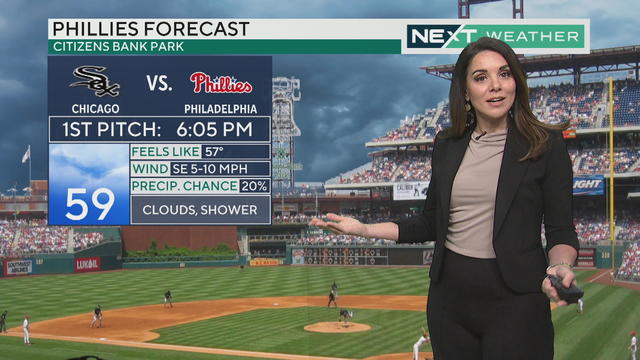

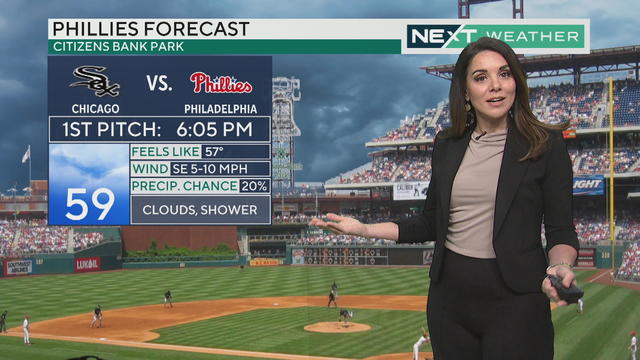

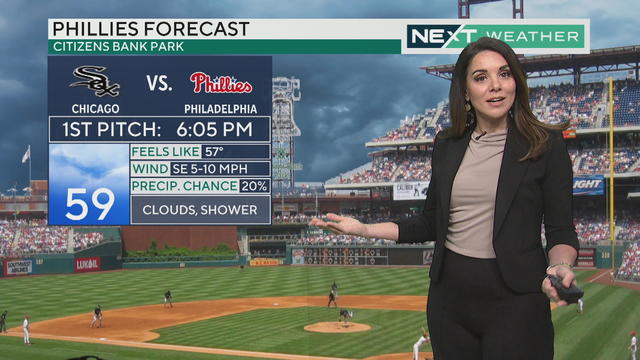

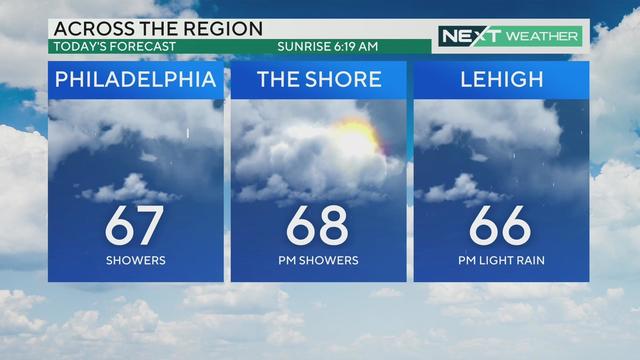

Friday is a mostly cloudy day, but some showers could pop up in the evening right around the first pitch of the Phillies home game against the Chicago White Sox.

NEXT Weather is about preparation and accuracy. It means No Surprises. So once it's on our radar - it's on yours.

A social worker from Fox Chase will be riding 100 miles to help people with lung cancer in a special Peloton distance event on Sunday.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Wills Eye on Diabetes Day is all about early detection and raising awareness, especially for people with diabetes, about the importance of eye exams.

David O'Brian will run in the Donor Dash in Philadelphia later this month to celebrate his daughter, an organ donor who died 10 years ago.

Montgomery County's Office of Public Health is investigating an increase in whooping cough cases primarily among high school students, a county spokesperson told CBS News Philadelphia on Monday.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

The latest CDC data from 2021 shows more than 1,200 women died of pregnancy complications up from 754 deaths in 2019.

Federal authorities are warning that unregulated Botox products are linked to an outbreak of botulism-like illnesses.

A unique initiative helps unlock the potential of people with autism by providing job training.

Jalen Hurts announced he will donate $200,000 to the School District of Philadelphia to purchase air conditioning units for 10 schools.

Caitlin Clark's WNBA contract went viral on social media after the numbers were revealed, but Philadelphia native Dawn Staley urged patience and said the league's stars will continue to grow the game.

Collin Wainwright won the 7 Mile Bridge Run in the Florida Keys for the third time over the weekend. He's coming home as a champion.

Carter won the Stanley Cup twice during his career while playing for the Penguins, Kings, Blue Jackets, and Flyers.

Kyle Schwarber hit two home runs, including the 250th of his career, Cristopher Sánchez pitched six strong innings and the Philadelphia Phillies completed a three-game sweep with a 7-6 victory over the Colorado Rockies.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Casey Pitocchelli chats with Pat Gallen about how he founded Rare Vntg and discusses the Phillies' Nike City Connect jerseys and Philly sports on the latest episode of Gallen of Questions.

"Dancing on My Own" has been the Philadelphia Phillies' celebration soundtrack for the last two years. In this week's episode, Unterberger, a Philly guy and Philly sports fan, comprises a list of potential new victory songs for the 2024 season.

Hannah Hidalgo, a Merchantville, New Jersey, native starred at Paul VI High School before heading to Notre Dame. Hidalgo sat down with Pat Gallen for a special Gallen of Questions web extra.

Philadelphia police are releasing surveillance video that they hope will help identify a suspect in an East Mount Airy shooting.

Dozens of firefighters battled a fire on the Atlantic City boardwalk on Thursday night, officials said.

A proposed waterfront park along the Schuylkill near 30th Street Station would feature a public pool, a natural beach and an entertainment venue.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

The swing set at Anna Verna Playground in FDR Park is the largest in North America. The playground opened in Fall 2023, so this will be its first spring and summer season.

Philadelphia police are releasing surveillance video that they hope will help identify a suspect in an East Mount Airy shooting.

A proposed waterfront park along the Schuylkill near 30th Street Station would feature a public pool, a natural beach and an entertainment venue.

The swing set at Anna Verna Playground in FDR Park is the largest in North America. The playground opened in Fall 2023, so this will be its first spring and summer season.

A middle school student is being charged after allegedly attacking another Pennbrook Middle School student with what schoolmates describe as a Stanley cup.

Jalen Hurts announced he will donate $200,000 to the School District of Philadelphia to purchase air conditioning units for 10 schools.

Friday is a mostly cloudy day, but some showers could pop up in the evening right around the first pitch of the Phillies home game against the Chicago White Sox.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Taylor Swift's new album "The Tortured Poets Department" is finally here. Here are some events in the Philadelphia area to celebrate the Berks County native's latest record.

Dozens of firefighters battled a fire on the Atlantic City boardwalk on Thursday night, officials said.

Residents of Tabernacle Township, New Jersey, are protesting the potential demolition of their community's Town Hall.

Friday is a mostly cloudy day, but some showers could pop up in the evening right around the first pitch of the Phillies home game against the Chicago White Sox.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Taylor Swift's new album "The Tortured Poets Department" is finally here. Here are some events in the Philadelphia area to celebrate the Berks County native's latest record.

It won't rain much Thursday but there could be chances of a light drizzle, especially early. Temperatures are cooler than usual with a high of only 57 degrees in Philadelphia.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

A social worker from Fox Chase will be riding 100 miles to help people with lung cancer in a special Peloton distance event on Sunday.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Wills Eye on Diabetes Day is all about early detection and raising awareness, especially for people with diabetes, about the importance of eye exams.

David O'Brian will run in the Donor Dash in Philadelphia later this month to celebrate his daughter, an organ donor who died 10 years ago.

Montgomery County's Office of Public Health is investigating an increase in whooping cough cases primarily among high school students, a county spokesperson told CBS News Philadelphia on Monday.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Wawa is officially in central Pennsylvania.

Cove Pocono Resorts' two other properties, Cove Haven Resort and Paradise Stream Resort, will remain open despite the closure of the Pocono Palace.

Nine life-sized sculptures made by world-renowned artist Seward Johnson are on loan to Philadelphia's Frankford Avenue in Mayfair until mid-September.

After a taste of summer on Monday, many Jersey Shore business owners and managers are still looking for summer workers.

Three construction workers died on I-83 in York County, Pennsylvania after a truck struck their vehicle in an active work zone, Pennsylvania State Police said.

One person died in a car accident in Pennsauken, Camden County, Tuesday afternoon, Pennsauken police said.

All lanes of the Pennsylvania Turnpike near Quakertown have reopened after a dump truck overturned Monday morning, according to the Pennsylvania Turnpike Commission.

A 21-year-old woman was killed after her car was struck by a drunken driver on I-95 northbound in Philadelphia, Pennsylvania State Police said Sunday.

Flooding closed multiple roads around the Philadelphia region for the morning commute on Friday, but they began reopening after around 8 a.m.

Jalen Hurts announced he will donate $200,000 to the School District of Philadelphia to purchase air conditioning units for 10 schools.

Caitlin Clark's WNBA contract went viral on social media after the numbers were revealed, but Philadelphia native Dawn Staley urged patience and said the league's stars will continue to grow the game.

Collin Wainwright won the 7 Mile Bridge Run in the Florida Keys for the third time over the weekend. He's coming home as a champion.

Carter won the Stanley Cup twice during his career while playing for the Penguins, Kings, Blue Jackets, and Flyers.

Kyle Schwarber hit two home runs, including the 250th of his career, Cristopher Sánchez pitched six strong innings and the Philadelphia Phillies completed a three-game sweep with a 7-6 victory over the Colorado Rockies.

From a new Taylor Swift to an exclusive Pearl Jam "Dark Matter" vinyl, Record Store Day 2024 will be a big one for record stores in the Philadelphia area and worldwide.

Taylor Swift's new album "The Tortured Poets Department" is finally here. Here are some events in the Philadelphia area to celebrate the Berks County native's latest record.

Taylor Swift's successes and failures, including the battle to regain control of her master recordings, are part of the syllabus at the University of California, Berkeley.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

Guitar legend Dickey Betts, who co-founded the Allman Brothers Band and wrote their biggest hit, "Ramblin' Man," has died.

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Mercy Career and Technical High School senior Taylor Houseman was one of two students selected to give a SEPTA bus a brand new look.

On this week's Focusing on the Future and the first day of Women's History Month, CBS Philadelphia talked with one high school senior who is making history.

Eagles quarterback Jalen Hurts is giving $200,000 to the School District of Philadelphia to buy air conditioning units for 10 schools.

The Rothman Orthopaedics Roller Rink has officially opened at Dilworth Park in Center City for another season.

An area of Route 202 that had seen issues due to sinkholes in the past is now reopened after soft soil caused a dip in the roadway to form. A more permanent fix to the sinkhole issues will be completed over the summer.

Students at Pennbrook Middle School in North Wales, Pennsylvania are shaken up after a seventh grader was attacked in the cafeteria- with what one student said was a Stanley cup. Kim Hudson has the latest from the Montgomery County school.

Philadelphia Parks and Recreation is kicking off the spring and summer with a celebration at Anna Verna Playground in FDR Park - home to the largest swingset in North America. Jan Carabeo takes you to the award-winning play space and even heads down a slide.