CBS News Live

CBS News Philadelphia: Local News, Weather & More

Watch CBS News

The battle for Pennsylvania is heating up as President Joe Biden hit the campaign trail in Philadelphia, just days after former President Donald Trump visited the swing state.

State Rep. Kevin Boyle has openly disclosed seeking treatment at mental health facilities over the years. Officials are still waiting for him to turn himself in following an arrest warrant.

Philadelphia-based drag queen Sapphira Cristál opened up about her journey as she seeks to become "America's Next Drag Superstar" on "RuPaul's Drag Race" season 16 finale Friday.

Residents of Tabernacle Township, New Jersey, are protesting the potential demolition of their community's Town Hall.

A Pennsylvania House Democrat introduced a resolution on Thursday that could expel State Rep. Kevin Boyle as he faces charges for violating a protection from abuse order.

Teachers and students at Montgomery County Community College in Blue Bell are using excess food to help fight food insecurity with a new program that benefits college students in need.

While the Battleship New Jersey is docked in South Philly for critical hull maintenance work, CBS Philadelphia got a tour of a "historic homecoming for the battleship."

Daniel Pierson, 41, was arrested for trying to rape and kidnap a woman outside a Redner's grocery store in Middletown Township, according to the Bucks County District Attorney's Office.

President Joe Biden stopped at Wawa on Thursday during his Philadelphia visit to campaign for the 2024 presidential election.

Police are still waiting for Pennsylvania State Representative Kevin Boyle to turn himself in following an arrest warrant. According to law enforcement officials, the warrant is for violating a protection of abuse order. Marcella Baietto shares how this situation has brought attention to Boyle's mental health.

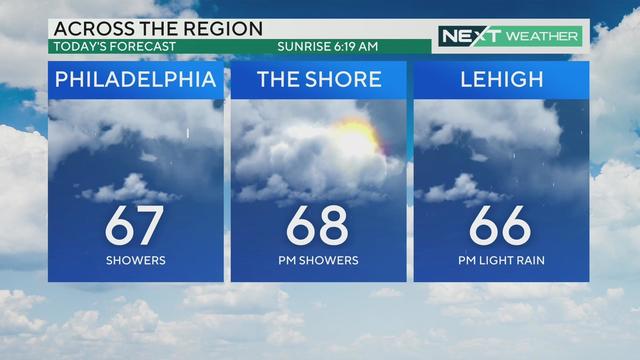

Bill Kelly has the latest weather forecast for the Philadelphia region.

This Sunday a social worker from Fox Chase will be riding 100 miles to help people with lung cancer. Stephanie Stahl reports.

The trip marks Biden's third stop in Pennsylvania this week. He recently visited Scranton and Pittsburgh.

Take a step inside a New Jersey fire tower, discover a ghost forest deep in the heart of Brendan T. Byrne State Forest and interact with Seward Johnson's sculpture art in Philadelphia's Mayfair neighborhood. Here's this week's The Pulse of CBS Philadelphia.

Health officials are warning consumers not to consume the Infinite Herbs basil sold at Trader Joe's after 12 people were sickened.

Wills Eye on Diabetes Day is all about early detection and raising awareness, especially for people with diabetes, about the importance of eye exams.

David O'Brian will run in the Donor Dash in Philadelphia later this month to celebrate his daughter, an organ donor who died 10 years ago.

Montgomery County's Office of Public Health is investigating an increase in whooping cough cases primarily among high school students, a county spokesperson told CBS News Philadelphia on Monday.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

The latest CDC data from 2021 shows more than 1,200 women died of pregnancy complications up from 754 deaths in 2019.

Federal authorities are warning that unregulated Botox products are linked to an outbreak of botulism-like illnesses.

A unique initiative helps unlock the potential of people with autism by providing job training.

Professional singer and actress Julia Rae is on a mission to give back at Children's Hospital of Philadelphia by sharing gifts called "Feel Better Boxes."

Carter won the Stanley Cup twice during his career while playing for the Penguins, Kings, Blue Jackets, and Flyers.

Kyle Schwarber hit two home runs, including the 250th of his career, Cristopher Sánchez pitched six strong innings and the Philadelphia Phillies completed a three-game sweep with a 7-6 victory over the Colorado Rockies.

The Philadelphia 76ers came back and defeated the Miami Heat, 105-104, in the NBA Play-In Tournament on Wednesday night at the Wells Fargo Center.

Jason Kelce said on his podcast "New Heights" on Wednesday that he lost his Philadelphia Eagles Super Bowl ring in a pool of chili while hosting an event last week at the University of Cincinnati.

Sixers superstar Joel Embiid was officially named to Team USA for the 2024 Summer Olympics in Paris, France, on Wednesday.

Elias Diaz, the man police believe is the "Fairmount Park Rapist," has been charged with three more unsolved rapes in addition to Rebecca Park's murder.

Just eight days after a recent CBS Mysteries report profiled Reiff's case, an arrest has finally been made.

It's been nearly 10 years since Carol Reiff, a beloved mother and friend from Gloucester Township, was found murdered in a wooded area not far from Route 42.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Casey Pitocchelli chats with Pat Gallen about how he founded Rare Vntg and discusses the Phillies' Nike City Connect jerseys and Philly sports on the latest episode of Gallen of Questions.

"Dancing on My Own" has been the Philadelphia Phillies' celebration soundtrack for the last two years. In this week's episode, Unterberger, a Philly guy and Philly sports fan, comprises a list of potential new victory songs for the 2024 season.

Hannah Hidalgo, a Merchantville, New Jersey, native starred at Paul VI High School before heading to Notre Dame. Hidalgo sat down with Pat Gallen for a special Gallen of Questions web extra.

The battle for Pennsylvania is heating up as President Joe Biden hit the campaign trail in Philadelphia, just days after former President Donald Trump visited the swing state.

State Rep. Kevin Boyle has openly disclosed seeking treatment at mental health facilities over the years. Officials are still waiting for him to turn himself in following an arrest warrant.

Philadelphia-based drag queen Sapphira Cristál opened up about her journey as she seeks to become "America's Next Drag Superstar" on "RuPaul's Drag Race" season 16 finale Friday.

Residents of Tabernacle Township, New Jersey, are protesting the potential demolition of their community's Town Hall.

A Pennsylvania House Democrat introduced a resolution on Thursday that could expel State Rep. Kevin Boyle as he faces charges for violating a protection from abuse order.

State Rep. Kevin Boyle has openly disclosed seeking treatment at mental health facilities over the years. Officials are still waiting for him to turn himself in following an arrest warrant.

Teachers and students at Montgomery County Community College in Blue Bell are using excess food to help fight food insecurity with a new program that benefits college students in need.

A Pennsylvania House Democrat introduced a resolution on Thursday that could expel State Rep. Kevin Boyle as he faces charges for violating a protection from abuse order.

While the Battleship New Jersey is docked in South Philly for critical hull maintenance work, CBS Philadelphia got a tour of a "historic homecoming for the battleship."

Daniel Pierson, 41, was arrested for trying to rape and kidnap a woman outside a Redner's grocery store in Middletown Township, according to the Bucks County District Attorney's Office.

Residents of Tabernacle Township, New Jersey, are protesting the potential demolition of their community's Town Hall.

While the Battleship New Jersey is docked in South Philly for critical hull maintenance work, CBS Philadelphia got a tour of a "historic homecoming for the battleship."

It won't rain much Thursday but there could be chances of a light drizzle, especially early. Temperatures are cooler than usual with a high of only 57 degrees in Philadelphia.

No one was injured when a school bus caught fire on New Jersey's Garden State Parkway in Upper Township Wednesday, Seaville Fire Rescue said.

Collingswood police and Camden County officials are investigating a group of students who allegedly formed a "White Student Union."

It won't rain much Thursday but there could be chances of a light drizzle, especially early. Temperatures are cooler than usual with a high of only 57 degrees in Philadelphia.

Temperatures stay relatively mild Wednesday with highs in the mid-to-upper 60s, but clouds and rain move into the Delaware Valley by the afternoon.

High temperatures Tuesday will reach the mid-70s with abundantly sunny skies, a light breeze and slight reduction in the humidity before more rain and chilly air moves in Wednesday.

Monday makes a run for 80 degrees, setting us up for the warmest day of the week and warmest day of the year so far. Later in the day, a thunderstorm could develop in South Jersey and Delaware.

30-year-old Dempsey Walters faces prison time after pleading guilty to assaulting two teenagers over a doorbell prank Friday.

Health officials are warning consumers not to consume the Infinite Herbs basil sold at Trader Joe's after 12 people were sickened.

Wills Eye on Diabetes Day is all about early detection and raising awareness, especially for people with diabetes, about the importance of eye exams.

David O'Brian will run in the Donor Dash in Philadelphia later this month to celebrate his daughter, an organ donor who died 10 years ago.

Montgomery County's Office of Public Health is investigating an increase in whooping cough cases primarily among high school students, a county spokesperson told CBS News Philadelphia on Monday.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

Wawa is officially in central Pennsylvania.

Cove Pocono Resorts' two other properties, Cove Haven Resort and Paradise Stream Resort, will remain open despite the closure of the Pocono Palace.

Nine life-sized sculptures made by world-renowned artist Seward Johnson are on loan to Philadelphia's Frankford Avenue in Mayfair until mid-September.

After a taste of summer on Monday, many Jersey Shore business owners and managers are still looking for summer workers.

Atlantic City, New Jersey's nine casinos collectively had lower profits in 2023 compared to 2022 - but three casinos were able to increase profit.

Three construction workers died on I-83 in York County, Pennsylvania after a truck struck their vehicle in an active work zone, Pennsylvania State Police said.

One person died in a car accident in Pennsauken, Camden County, Tuesday afternoon, Pennsauken police said.

All lanes of the Pennsylvania Turnpike near Quakertown have reopened after a dump truck overturned Monday morning, according to the Pennsylvania Turnpike Commission.

A 21-year-old woman was killed after her car was struck by a drunken driver on I-95 northbound in Philadelphia, Pennsylvania State Police said Sunday.

Flooding closed multiple roads around the Philadelphia region for the morning commute on Friday, but they began reopening after around 8 a.m.

Carter won the Stanley Cup twice during his career while playing for the Penguins, Kings, Blue Jackets, and Flyers.

Kyle Schwarber hit two home runs, including the 250th of his career, Cristopher Sánchez pitched six strong innings and the Philadelphia Phillies completed a three-game sweep with a 7-6 victory over the Colorado Rockies.

The Philadelphia 76ers came back and defeated the Miami Heat, 105-104, in the NBA Play-In Tournament on Wednesday night at the Wells Fargo Center.

Jason Kelce said on his podcast "New Heights" on Wednesday that he lost his Philadelphia Eagles Super Bowl ring in a pool of chili while hosting an event last week at the University of Cincinnati.

Sixers superstar Joel Embiid was officially named to Team USA for the 2024 Summer Olympics in Paris, France, on Wednesday.

Taylor Swift took to social media hours ahead of the expected release of her new album "The Tortured Poets Department."

Philadelphia-based drag queen Sapphira Cristál opened up about her journey as she seeks to become "America's Next Drag Superstar" on "RuPaul's Drag Race" season 16 finale Friday.

"I miss her hugs," Warwick Davis said of the passing of his wife Samantha Davis. "With her by my side, I was sure I could achieve anything. It was like having a super-power."

Philadelphia native, Oscar and Golden Globe winner Da'Vine Joy Randolph is on the list of TIME's 100 Most Influential People of 2024.

O.J. Simpson's longtime lawyer in Las Vegas says the end came quickly.

Ukee Washington reports.

Natasha Brown reports.

Natasha Brown reports.

Natasha Brown reports.

Ukee Washington reports.

William Bodine High School's robotics team is one of a few schools in the area set to represent Philadelphia at the FIRST Robotics Competition World Championship in Texas.

Two Bucks County girls wrestling medal winners are hopeful more young women will get involved in the male-dominated sport.

Students in Philadelphia's Law Pathway program are learning more about a possible legal career with help from Penn's law school and the Troutman Pepper law firm.

Mercy Career and Technical High School senior Taylor Houseman was one of two students selected to give a SEPTA bus a brand new look.

On this week's Focusing on the Future and the first day of Women's History Month, CBS Philadelphia talked with one high school senior who is making history.

Police are still waiting for Pennsylvania State Representative Kevin Boyle to turn himself in following an arrest warrant. According to law enforcement officials, the warrant is for violating a protection of abuse order. Marcella Baietto shares how this situation has brought attention to Boyle's mental health.

Bill Kelly has the latest weather forecast for the Philadelphia region.

This Sunday a social worker from Fox Chase will be riding 100 miles to help people with lung cancer. Stephanie Stahl reports.

The trip marks Biden's third stop in Pennsylvania this week. He recently visited Scranton and Pittsburgh.

Take a step inside a New Jersey fire tower, discover a ghost forest deep in the heart of Brendan T. Byrne State Forest and interact with Seward Johnson's sculpture art in Philadelphia's Mayfair neighborhood. Here's this week's The Pulse of CBS Philadelphia.