City Officials Receive Fewer Calls Than Expected About Tax Assessments

By Mike Dunn

PHILADELPHIA (CBS) - City officials insist that the phones have not exactly been ringing off the hook in response to the new property assessments that appeared in the mail last week.

The Office of Property Assessment hired an outside firm to handle phone calls from potentially confused if not angry homeowners when the new property values were received. It staffed with a few dozen operators during normal business hours at a center in Blue Bell.

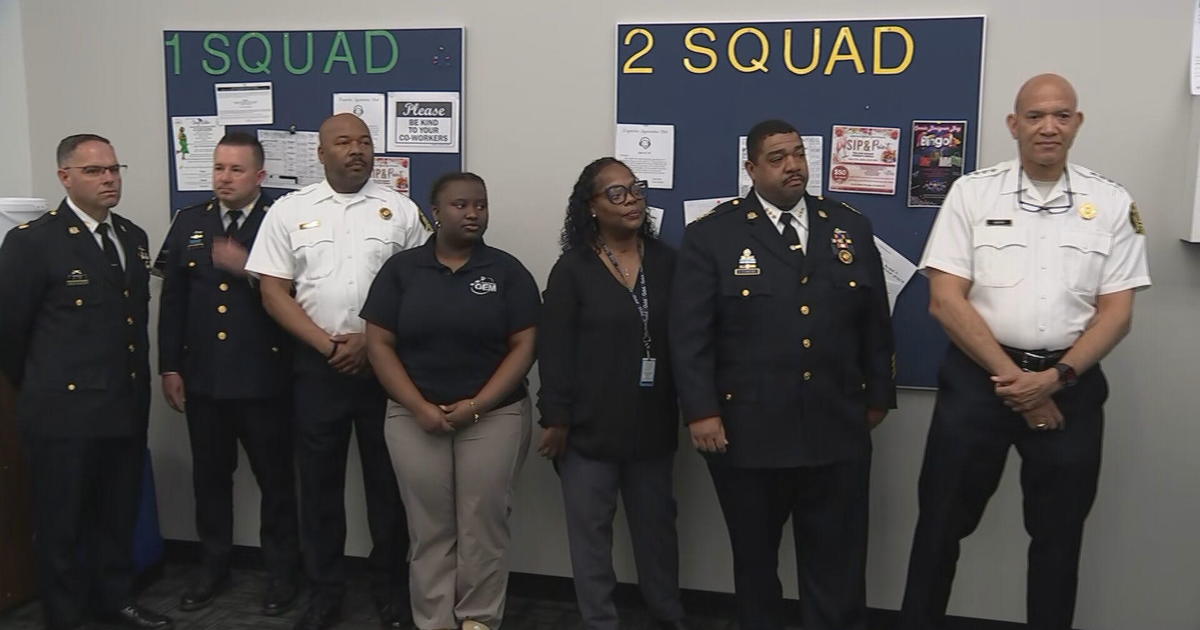

Assistant Administrator Marisa Waxman says from the 15th, when they were mailed, through Sunday the center received about 14,000 phone calls:

"It's actually been a little lower than our initial expectations. That said, it's still quite a number of phone calls and emails and all of that."

Waxman says callers who are upset with their new assessment are being told how to file the low-level appeal known as the "first level review" process. Others, she says, have questions about the Homestead Exemption, a relief mechanism for residential owners that may be offered by the city.

The OPA's website is also busy, receiving 1650 questions from visitors, and 30,000 unique visitors to the page that calculates an owner's potential tax liability.

For AVI information, call 215-686-9200 or visit phila.gov/opa, and the tax calculator is avicalculator.phila.gov