Lost Debit Card Liabilities

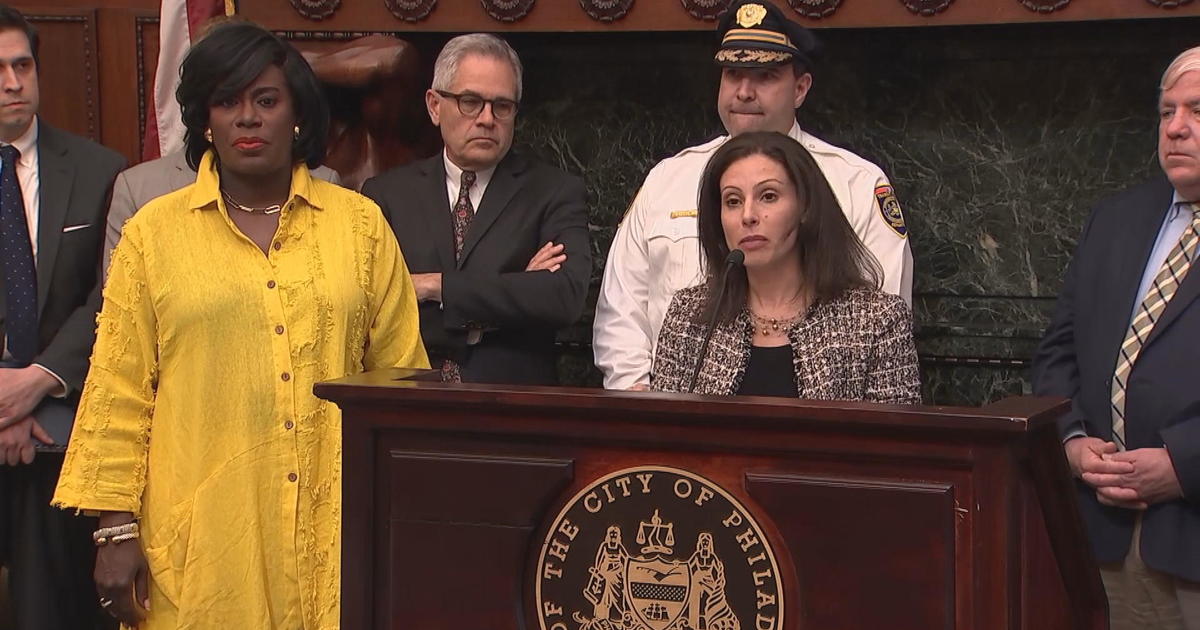

By Amy E. Feldman

PHILADELPHIA (CBS) - What happens if there's an unauthorized transaction on your ATM card?

We've all heard the commercial - "What's in your wallet?" But the real question is "What isn't?" If your travelers checks are lost or stolen, you are protected. If your credit cards are stolen and used without your authorization you are protected if you've reported the loss.

Your liability under federal law for unauthorized use of your debit or ATM card depends on how quickly you report the loss. If you report your card missing before it's been used fraudulently, the card issuer can't hold you responsible. If you report the loss within two business days after you realize your card is missing - but after a fraudulent transfer - you will not be responsible for more than $50 of the unauthorized use. But if you don't report the loss within 2 days, you could be liable for up to $500 and your liability would be unlimited if you fail to report it within 60 days after your bank statement arrives.

NEVER NEVER NEVER leave your PIN number with your ATM card, and of course make sure the card hasn't been lost by checking on what's in your wallet.